What is the FED view on inflation? Does it expect it to rise compared with June report?

What is the FED view on fed funds rate? Does it expect a raise or fall compared with June report?

Hawkish Fed

FOMC is made up of 18 members.

· More than 10 members expect core PCE to be more than 3.6 in 2024. Inflation will more likely remain sticky and they will keep rates for long to bring inflation down to their 2 percent target.

· More than 10 members expect fed funds rate to be around 5.75 and the same by end of 2024 and leaves some room for further hikes. That implies that fed will hike two more times this year and will keep rates unchanged in 2024 with further possibility of more hikes.

Bearish Fed

· More than 10 members expect core PCE to fall below 2 percent in 2024. This implies Inflation will fall gradually and fed will be ready to cut rates to support any slowdown in the economy.

· More than 10 members expect fed funds rate to be below 4.5 by the end of 2024. That implies that fed will cut rates by 100 basis points in 2024. That will signal a pause that will be followed by rate cuts.

The idea is to know whether we will get any further rates increases, how long will fed pause, when they will start to cut rates.

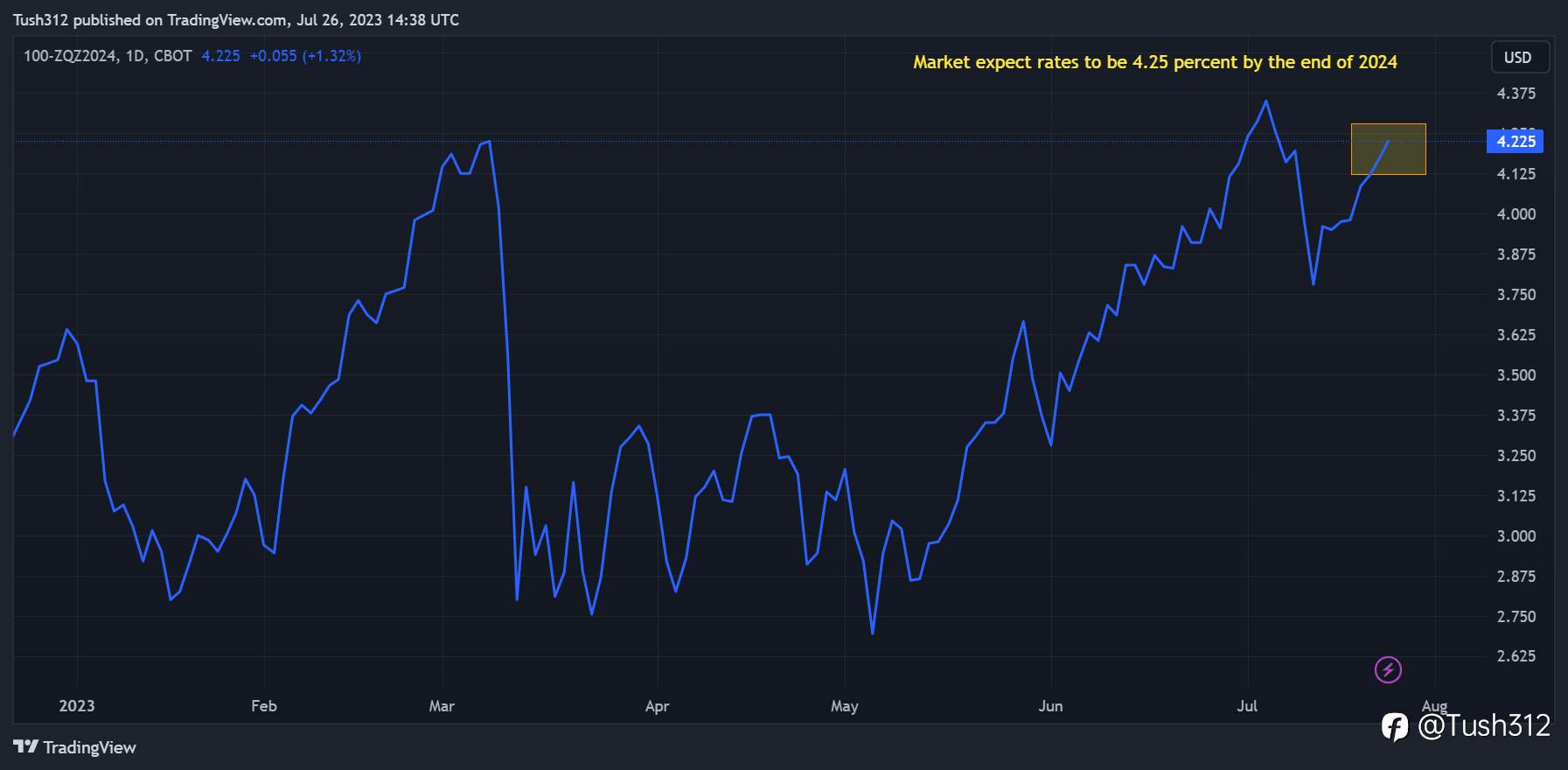

Market expect Fed to hike rates to the range of 5.5-5.75 by December 2023 and cut rates by 125 basis points by the end of 2024 any surprises will bring volatility in the market.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()