- CySEC has announced a settlement with ISPASS Technologies.The company offers MetaTrader's integration and trading plugins development.

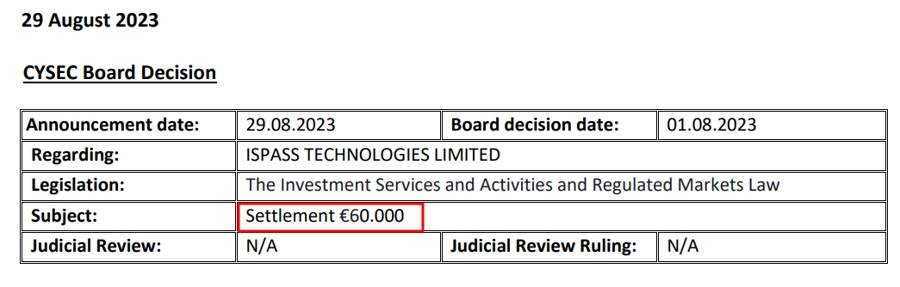

- Maintaining a high level of regulatory activity, the Cyprus Securities and Exchange Commission (CySEC) has issued another decision on a regulated company. According to the institution's latest announcement, ISPASS Technologies Limited has reached a settlement with the Cypriot watchdog for the sum of €60,000.

-

CySEC Settles with ISPASS Technologies

Although ISPASS is a tech company that deals with, among other things, the development of web and mobile applications as well as marketing automation, it is also directly related to the retail investment industry. The company offers services, such as integrating the MetaTrader platform and developing plugins for MetaTrader 5.

Source: ISPASS Technologies

The settlement comes after an investigation into the company's compliance with the Investment Services and Activities and Regulated Markets Law of 2017, specifically Article 5(1), which pertains to Cypriot Investment Firm (CIF) authorization requirements.

CySEC, under the Cyprus Securities and Exchange Commission Law of 2009, holds the authority to settle any violations or potential violations related to its supervised legislation. The settlement with ISPASS Technologies Limited was reached under this framework, focusing on the company's compliance from November 2021 to September 2022.

ISPASS Technologies Limited has fully paid the settlement amount of €60,000. According to CySEC, all funds received from such settlements are directed to the Treasury of the Republic and do not constitute income for CySEC itself.

Source: CySEC

Recent Actions by CySEC

Last week, CySEC barred RoboMarkets, a forex and CFDs broker, from offering non-cash incentives like race tickets and company-branded items to its retail clients.

The announcement was made last Wednesday, although CySEC's Board made the decision earlier in March.

Simultaneously, CySEC has initiated an inquiry into Ayers Alliance, formerly known as Harborx Ltd., for possible regulatory breaches. While the regulator didn't share any specific details, it hinted at the possibility of financial penalties upon the conclusion of the investigation. In a separate statement, the regulated firm indicated that reimbursing all of its clients could result in operational challenges.

Earlier in July, CySEC levied a €100,000 administrative fine on BDSwiss Holding Ltd, a company that operates a forex and CFDs brokerage named BDSwiss. Additionally, MultiBank has received a licence from CySEC to broaden its derivatives brokerage offerings in Europe. The firm, which underwent a rebranding from IKON MultiBank Group in 2016, stated that the license was granted to its Cyprus-based subsidiary, MEX Europe.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()