| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 8200.5 |

| Take Profit | 8370.0 |

| Stop Loss | 8100.0 |

| Key Levels | 7970.0, 8110.0, 8200.0, 8370.0 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 8110.5 |

| Take Profit | 7970.0 |

| Stop Loss | 8200.0 |

| Key Levels | 7970.0, 8110.0, 8200.0, 8370.0 |

Current trend

The leading index of the London Stock Exchange FTSE 100 is showing upward dynamics at 8151.0, which is largely due to a new correction in the bond market.

Despite rather weak corporate reports from component companies, index quotes are showing local growth. Construction holding company CRH Plc. posted revenue of 7.59 billion pounds, missing the forecast of 8.02 billion pounds, and earnings per share of 1.48 pounds, beating the expected 1.42 pounds. Today, the reporting will continue, although mainly the results of French companies that have an additional listing in London, but do not have sufficient capitalization to influence the quotes, will be published.

In turn, yields across the entire range of UK debt securities have begun to rise again. The 10-year bonds yield rose to 3.981%, down from last week's 4.043% but above Monday's 3.831%, the 20-year bonds rose to 4.447%, down from last week's 4.518% but above 4.346% earlier in the week, and the 30-year bonds rose to 4.540% from 4.443%.

The growth leaders in the index are Beazley Plc. ( 10.75%), Hikma Pharmaceuticals Plc. ( 8.26%), Entain Plc. ( 5.08%), Persimmon Plc. ( 2.79%).

Among the leaders of the decline are Spirax-Sarco Engineering Plc. (–7.44%), United Utilities Group Plc. (–4.37%), BT Group Plc. (–4.01%).

Support and resistance

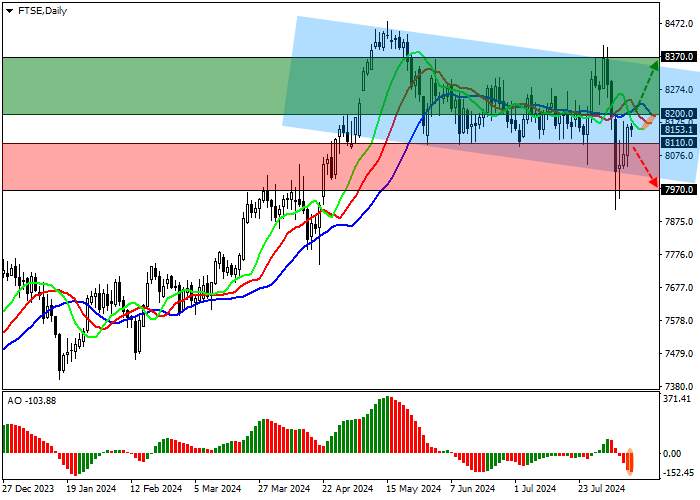

On the daily chart, the index quotes continue a local correction, holding slightly above the support line of the descending channel with boundaries of 8350.0–8000.0.

Technical indicators are in a state of uncertainty and are preparing to start slowing down the local sell signal: the EMA fluctuation range on the Alligator indicator narrows, and the AO histogram forms new correction bars, reversing towards growth.

Support levels: 8110.0, 7970.0.

Resistance levels: 8200.0, 8370.0.

Trading tips

If the index continues growing, and the price consolidates above the resistance at 8200.0, long positions with a target of 8370.0 and stop-loss of 8100.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining, and the price consolidates below 8110.0, short positions can be opened with the target at 7970.0. Stop-loss — 8200.0.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()