| Scenario | |

|---|---|

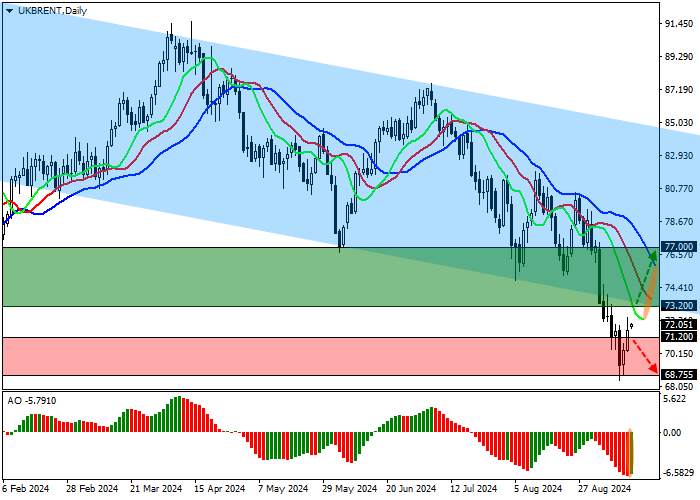

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 73.20 |

| Take Profit | 77.00 |

| Stop Loss | 71.00 |

| Key Levels | 68.75, 71.20, 73.20, 77.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 71.20 |

| Take Profit | 68.75 |

| Stop Loss | 72.00 |

| Key Levels | 68.75, 71.20, 73.20, 77.00 |

Current trend

Prices for the benchmark Brent Crude Oil grade are correcting in a local uptrend, holding slightly above 72.00.

The dynamics of quotations were due to the report of the International Energy Agency (IEA), which indicates that almost all countries exceeded oil production restrictions. Thus, in August, OPEC countries produced 41.46M barrels per day of oil, which is 0.92M barrels per day above the quota of 40.54M barrels per day. Among the regions that exceeded their restrictions were Russia and Saudi Arabia, and the figure for non-OPEC producers was 14.09M barrels per day, 1.51M barrels per day above the quota. As a result, IEA experts forecast an increase in oil supply by the end of the year by 0.6M barrels and by 2.1M barrels per day in 2025, which creates a significant surplus that puts pressure on the quotes. If these data coincide with OPEC estimates, a revision of production restrictions is likely, given that the organization has previously compensated for such dynamics.

Meanwhile, according to data from the Chicago Mercantile Exchange (CME Group), the daily trading volume of oil contracts fell to 920.0–930.0K from an average of 1.23–1.26M at the beginning of the month. The option position, the first signal of upcoming volatility in the market, also decreased: yesterday, it amounted to 181.9K, much less than 312.0–320.0K last week.

Support and resistance

On the daily chart, the trading instrument is held below the correction channel 85.00–73.00.

Technical indicators are slowing down the sell signal: fast EMAs of the Alligator indicator are approaching the signal line, and the AO histogram has formed the first ascending bar in the sell zone.

Resistance levels: 73.20, 77.00.

Support levels: 71.20, 68.75.

Trading tips

Long positions may be opened after the price rises and consolidates above 73.20, with the target at 77.00. Stop loss — 71.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 71.20, with the target at 68.75. Stop loss — 72.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()