| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 143.40 |

| Take Profit | 146.47 |

| Stop Loss | 142.30 |

| Key Levels | 138.11, 140.00, 143.40, 146.47 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 140.00 |

| Take Profit | 138.11 |

| Stop Loss | 141.00 |

| Key Levels | 138.11, 140.00, 143.40, 146.47 |

Current trend

The USD/JPY pair is correcting at 142.82 amid a decline in trading activity ahead of tomorrow’s meeting of the Bank of Japan. The key factor in further dynamics remains the volume of interest rate adjustment. Yesterday, US Fed officials cut the cost of borrowing by –50 basis points. If the Bank of Japan increases the indicator even by a low of 0.25%, the gap between the indicators will significantly narrow, putting pressure on the Japanese currency in the short term.

The American dollar is holding close to the annual low of 100.70 in the USDX, while investors are assessing the US Fed’s decision. On the one hand, the interest rate cut to 4.75–5.00% was planned, and the head of the regulator, Jerome Powell, noted that at least one more adjustment of the indicator might follow before the end of the year. On the other hand, the change was quite sharp, and it is still unknown how inflation will behave without monetary pressure. At 14:30 (GMT 2), data from the labor market is due, which may clarify the situation.

In these conditions, the upward dynamics of the USD/JPY pair is the most likely scenario.

Support and resistance

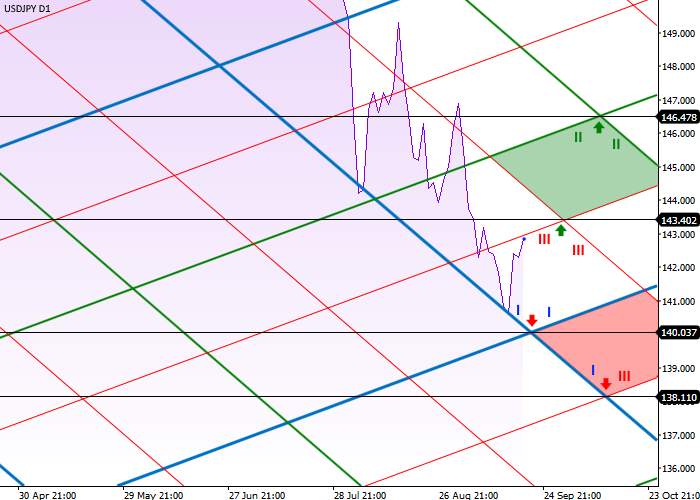

On the daily chart, the trading instrument reversed at the crosshair of the left support of the first order (I) and the right support of the first order (I) at 140.00, significantly increasing the probability of movement in a stable upward trend. The price may reach the crosshair of the left resistance of the third order (III) and the right resistance of the third order (III) at 143.40, and then the crosshair of the left resistance of the second order (II) and the right resistance of the second order (II) at 146.47.

An alternative option is a downward trend development, where the crosshair of the left support of the first order (I) and the right support of the first order (I) at 140.00 will become the immediate target. The crosshair of the left support of the first order (I) and the right support of the third order (III) at 138.11 will become the long-term one.

Resistance levels: 143.40, 146.47.

Support levels: 140.00, 138.11.

Trading tips

Long positions may be opened after the price consolidates above 143.40, with the target at 146.47. Stop loss — 142.30. Implementation period: 7 days or more.

Short positions may be opened after the price consolidates below 140.00, with the target at 138.11. Stop loss — around 141.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()