| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 42380.0 |

| Take Profit | 43800.0 |

| Stop Loss | 41900.0 |

| Key Levels | 39950.0, 41550.0, 42380.0, 43800.0 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 41550.0 |

| Take Profit | 39950.0 |

| Stop Loss | 41800.0 |

| Key Levels | 39950.0, 41550.0, 42380.0, 43800.0 |

Current trend

The Dow Jones Index is correcting in a local uptrend at 42008.0, supported by the US Federal Reserve's decision to cut interest rates by 50 basis points, which in the long term will lead to a weakening of the debt burden and a reduction in the cost of borrowing for national companies.

The upward trend will likely be strengthened by the situation on the labor market, where Initial Jobless Claims fell to a minimum of 219.0 thousand over the past four months from 231.0 thousand last week, and Continuing Jobless Claims fell to 1.829 million from 1.843 million previously, which is significantly lower than the forecast of 1.850 million. The Federal Reserve Bank of Philadelphia also published positive results: the Manufacturing PMI in September rose to 1.7 points from –7.0 points a month earlier.

The bond market responded to the results of the US Federal Reserve meeting by strengthening the downward trend: the yield on 10-year debt securities fell to 3.713% from 3.898%, 20-year ones to 4.102% from 4.268% two weeks earlier, and 30-year ones to 4.047% from 4.190%.

The growth leaders in the index are Salesforce Inc. ( 5.37%), Caterpillar Inc. ( 5.12%), Goldman Sachs Group Inc. ( 3.97%).

Among the leaders of the decline are Coca-Cola Co. (–1,57%), Procter & Gamble Company (–1,37%), Walmart Inc. (–1,25%).

Support and resistance

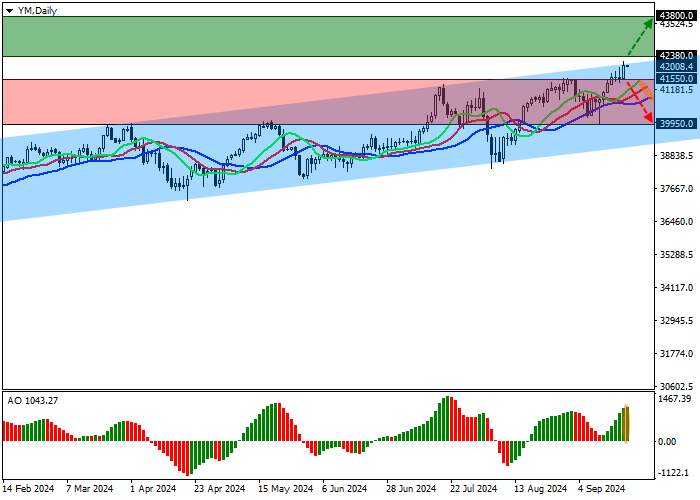

On the daily chart, the index quotes continue their corrective dynamics, again approaching the resistance line of the ascending channel with boundaries of 42200.0–39000.0.

Technical indicators that support the upward signal are gradually strengthening it: the range of EMA fluctuations on the Alligator indicator is expanding, and the AO histogram is forming new upward bars, being held above the transition level.

Support levels: 41550.0, 39950.0.

Resistance levels: 42380.0, 43800.0.

Trading tips

If growth continues, long positions that can be opened if the price overcomes the channel resistance at 42380.0 with a target at 43800.0 and stop-loss at 41900.0 will be relevant. Implementation time: 7 days and more.

If the asset reverses and continues declining and the price consolidates below the local support level of 41550.0, short positions can be opened with the target at 39950.0. Stop-loss — 41800.0.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()