| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 2656.30 |

| Take Profit | 2812.50, 2968.75 |

| Stop Loss | 2540.00 |

| Key Levels | 2031.25, 2187.50, 2343.75, 2656.25, 2812.50, 2968.75 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 2343.70 |

| Take Profit | 2187.50, 2031.25 |

| Stop Loss | 2430.00 |

| Key Levels | 2031.25, 2187.50, 2343.75, 2656.25, 2812.50, 2968.75 |

Current trend

The ETH/USD pair started the week with a significant increase within the framework of the general market trend and is now trading around 2620.00. Experts note that the strengthening of digital assets may be due to an increase in Donald Trump's chances of winning the US presidential race, which are now, according to the Polymarket forecasting platform, the largest since July.

Earlier, the Republican candidate had already promised to make BTC one of the reserve assets, replace the head of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, and soften the attitude of the authorities towards the cryptocurrency sector. Against this background, the inflow of investments in both spot Bitcoin ETFs and Ethereum ETFs increased: in particular, investments in the latter on Monday amounted to 17.0 million dollars.

Nevertheless, the upward dynamics of the market is not yet seen as stable due to the continued negative impact of monetary and geopolitical factors. The latest statistics confirming the strengthening of the labor market and the slowdown in the rate of decline in inflation contribute to a more cautious approach by the US Federal Reserve to further reduction of interest rates. By the end of the year, most experts expect a twofold reduction in the cost of borrowing, by 25 basis points each, but they also admit the possibility of only one adjustment. In addition, there is a possibility of an increase in the growth of tensions in the Middle East, which generally leads to the abandonment of risky assets and an increase in investments in gold and the US dollar.

Thus, further growth in cryptocurrency prices is still possible, but its potential is limited.

Support and resistance

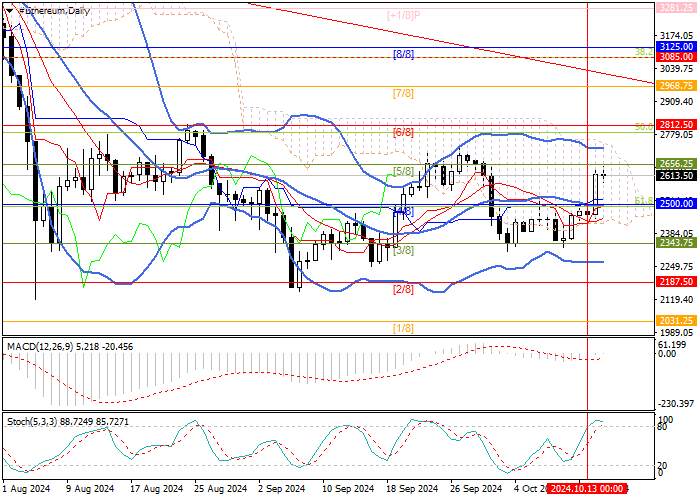

Technically, the price is close to the 2656.25 mark (Murrey level [5/8]), consolidating above which will allow quotes to continue growing towards the targets of 2812.50 (Murrey level [6/8]) and 2968.75 (Murrey level [7/8]). The key for the "bears" is the level of 2343.75 (Murrey level [3/8]), which the asset has repeatedly tested over the past two months and whose breakdown will ensure an intensification in downward dynamics to 2187.50 (Murrey level [2/8]) and 2031.25 (Murrey level [1/8]).

Technical indicators do not give a clear signal: Bollinger Bands are horizontal, MACD is at the zero line, its volumes are insignificant, and Stochastic is preparing to leave the overbought zone.

Resistance levels: 2656.25, 2812.50, 2968.75.

Support levels: 2343.75, 2187.50, 2031.25.

Trading tips

Long positions can be opened above the 2656.25 mark with targets of 2812.50, 2968.75 and a stop-loss around 2540.00. Implementation period: 5–7 days.

Short positions can be opened below the level of 2343.75 with targets of 2187.50, 2031.25 and a stop-loss around 2430.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()