| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY LIMIT |

| Entry Point | 0.8610 |

| Take Profit | 0.8745 |

| Stop Loss | 0.8570 |

| Key Levels | 0.8405, 0.8510, 0.8610, 0.8745, 0.8870, 0.9020 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.8505 |

| Take Profit | 0.8405 |

| Stop Loss | 0.8540 |

| Key Levels | 0.8405, 0.8510, 0.8610, 0.8745, 0.8870, 0.9020 |

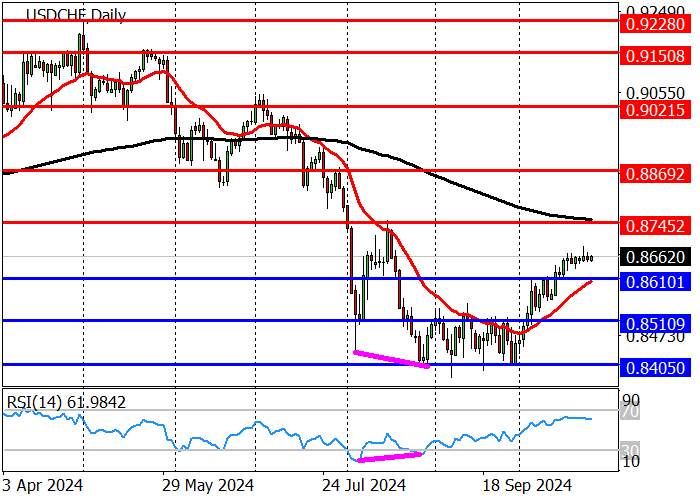

Current trend

The USD/CHF pair has been trading near the 0.8650 mark for the seventh day, which indicates that large market participants have accumulated positions before a further impulse.

Since the beginning of October, the positive dynamics have been due to the American dollar strengthening under the influence of the labor market data. The September nonfarm payrolls amounted to 254.0K, exceeding the forecast of 147.0K by 1.7 times, and the previous value was corrected from 142.0K to 159.0K, and unemployment decreased from 4.2% to 4.1%.

The franc is under pressure from declining inflation, which in October amounted to 0.8% YoY, below the forecast of 1.1% and the previous value of 1.1%. Because of this, at the meeting on December 12, officials of the Swiss National Bank (SNB) may leave the interest rate at 1.00% or reduce it.

At the beginning of October, the quotes reversed into a long-term upward trend, consolidated above the resistance level of 0.8625 and heading towards 0.8745 and 0.8870. After adjusting to the nearest support level of 0.8610, long positions, with the target at 0.8745 are relevant. In case of a breakdown, the downward dynamics will reach the area of 0.8510. The RSI indicator (14) is growing and approaching the overbought zone but does not enter it, which allows for considering long positions along the trend.

Last week, the medium-term trend reversed upwards, and the quotes broke the target zone of 0.8634–0.8611 and headed to zone 2 (0.8921–0.8892). In case of correction to the support area of 0.8417–0.8391, long positions with the target at the weekly high of 0.8685 are relevant.

Support and resistance

Resistance levels: 0.8745, 0.8870, 0.9020.

Support levels: 0.8610, 0.8510, 0.8405.

Trading tips

Long positions may be opened from 0.8610, with the target at 0.8745 and stop loss 0.8570. Implementation period: 9–12 days.

Short positions may be opened below 0.8510, with the target at 0.8405 and stop loss 0.8540.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()