| Scenario | |

|---|---|

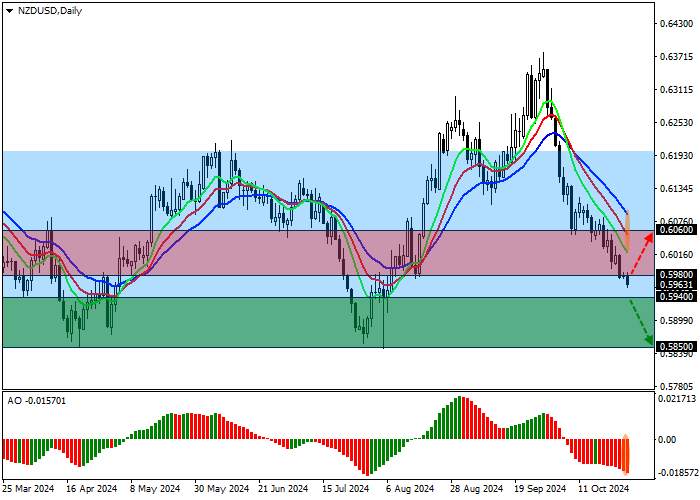

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.5940 |

| Take Profit | 0.5850 |

| Stop Loss | 0.6020 |

| Key Levels | 0.5850, 0.5940, 0.5980, 0.6060 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.5980 |

| Take Profit | 0.6060 |

| Stop Loss | 0.5920 |

| Key Levels | 0.5850, 0.5940, 0.5980, 0.6060 |

Current trend

The NZD/USD pair is correcting at 0.5963 amid the strengthening of the American currency. In New Zealand, the beginning of the week will remain low-volatility due to the lack of macroeconomic publications and the celebration of Labor Day, which is why the Wellington Stock Exchange is closed today.

Investors expect the Reserve Bank of New Zealand (RBNZ) to ease monetary policy: speaking at the Peterson Institute, the head of the department, Adrian Orr, noted that inflation at 2.2%, almost in the middle of the target range of 1.0–3.0%, allows for a reduction in the interest rate but its adjustment will be applied only as a last resort, and if the indicators begin to deteriorate, a decision to maintain the cost of borrowing at the current level of 4.75% may be made. However, analysts expect the value to change by –50 basis points in November, supporting the national currency.

The American dollar is holding at 104.30 in USDX amid positive macroeconomic reports: in October, expected inflation from the University of Michigan decreased from 2.9% to 2.7%, and the index of consumer inflation expectations for the next five years remained at 3.0%. The consumer expectations indicator increased from 72.9 points to 74.1 points, and consumer sentiment – from 68.9 points to 70.5 points, because of which the current conditions indicator rose from 62.7 points to 64.9 points.

Support and resistance

The trading instrument is correcting, approaching the support line of the sideways channel 0.6200–0.5850. Technical indicators reinforce the downward signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming downward bars below the transition level.

Resistance levels: 0.5980, 0.6060.

Support levels: 0.5940, 0.5850.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.5940, with the target at 0.5850. Stop loss is 0.6020. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 0.5980, with the target at 0.6060. Stop loss is 0.5920.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()