| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 70.30 |

| Take Profit | 65.50 |

| Stop Loss | 72.00 |

| Key Levels | 65.50, 70.30, 72.40, 77.00 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 72.40 |

| Take Profit | 77.00 |

| Stop Loss | 70.00 |

| Key Levels | 65.50, 70.30, 72.40, 77.00 |

Current trend

Prices for benchmark Brent Crude Oil are correcting in a local downtrend, trading just below 71.00, decreasing amid a significant easing of geopolitical tensions in the Middle East. During Israel’s recent retaliatory actions against Iranian military facilities, oil infrastructure was not affected. Experts believe that official Jerusalem was under the influence of the US authorities, who warned it against massive attacks before the US presidential elections.

In addition, the asset is under pressure from oil reserves data. According to preliminary estimates, the American Petroleum Institute (API) report will reflect a change from 1.643M barrels to 0.600M barrels, and the Energy Information Administration of the US Department of Energy (EIA) report will record an increase from 5.474M barrels.

Meanwhile, according to the Chicago Mercantile Exchange (CME Group), trading volumes in oil contracts increased from 0.750M to 1.300M per day. Given the current dynamics, most of it is sell transactions, negatively affecting oil prices.

Support and resistance

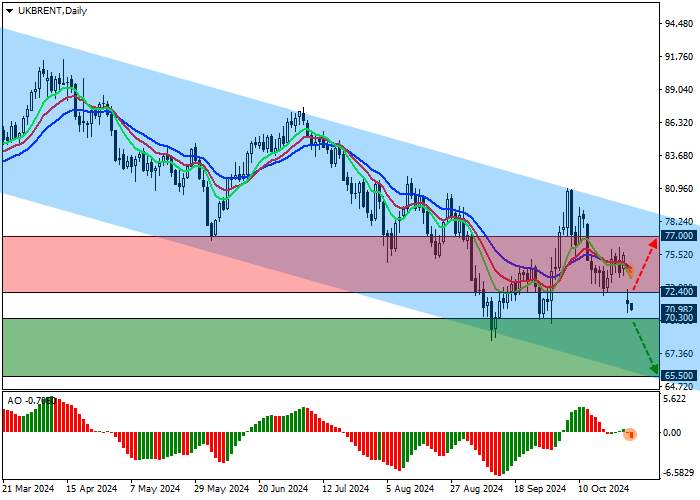

On the daily chart, the trading instrument is moving within the correction channel 78.50–65.50, falling to its support line.

Technical indicators have given a sell signal: fast EMAs of the Alligator indicator have crossed the signal line downwards, and the AO histogram has formed several downward bars in the sell zone.

Resistance levels: 72.40, 77.00.

Support levels: 70.30, 65.50.

Trading tips

Short positions may be opened after the price declines and consolidates below 70.30, with the target at 65.50. Stop loss is 72.00. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 72.40, with the target at 77.00. Stop loss is 70.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()