| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 28.15 |

| Take Profit | 26.80 |

| Stop Loss | 29.00 |

| Key Levels | 26.80, 28.20, 29.00, 30.10 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 29.05 |

| Take Profit | 30.10 |

| Stop Loss | 28.50 |

| Key Levels | 26.80, 28.20, 29.00, 30.10 |

Current trend

Shares of Pfizer Inc., the largest American pharmaceutical company, are adjusting at the 29.00 mark in the absence of drivers capable of changing the direction of price dynamics, since the company has not been able to find its niche after switching from the sale of COVID-19 vaccine to drugs of a wider range.

In particular, as Jeff Jonas, a leading analyst at the Gabelli Funds hedge fund, notes, Pfizer Inc. has made significant investments in an anti-obesity drug, but the results of its latest trials have been disappointing. The recent launch of a vaccine against respiratory syncytial virus (RSV) and the refusal to develop a drug for the treatment of sickle cell anemia also failed to meet expectations. According to the expert, even if the results for the third quarter turn out to be higher than expected, this will not be enough to convince new investors of the company's prospects.

Today, Pfizer Inc. will release its third quarter financial report: revenue is expected to reach 14.92 billion dollars, up from 13.30 billion dollars in the previous quarter and 13.20 billion dollars over the same period a year earlier. Earnings per share (EPS) could be 0.615 dollars, up from 0.600 dollars in the second quarter and ˗0.170 dollars over the same period a year earlier.

Support and resistance

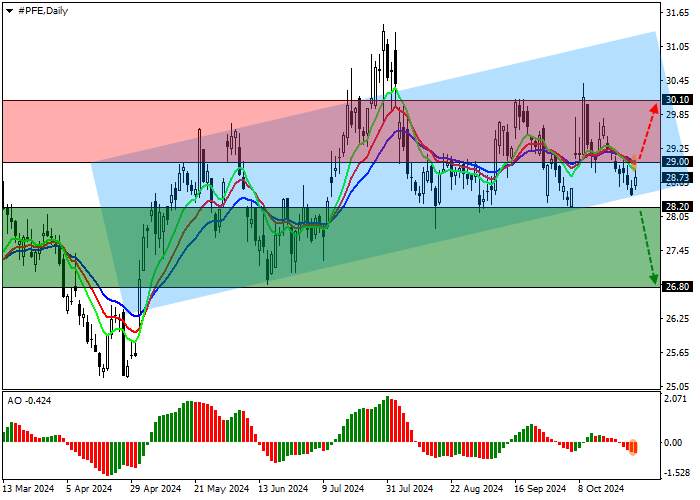

On the D1 chart, the asset is adjusting, being above the support line of the ascending channel with the boundaries of 32.00–28.40.

The technical indicators reversed around and issued a new sell signal, which confirms the high probability of a decline: the fast EMAs of the Alligator indicator crossed the signal line from the top down, expanding the range of fluctuations, and the AO histogram has already moved into the sales zone.

Support levels: 28.20, 26.80.

Resistance levels: 29.00, 30.10.

Trading tips

If the asset continues to decline and the price consolidates below the support level of 28.20, one can open short positions with a target of 26.80 and a stop-loss of 29.00. Implementation time: 7 days and more.

In case of continued global growth of the asset, as well as price consolidation above the resistance level of 29.00, one may open long positions with a target of 30.10 and a stop-loss of 28.50.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()