| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 154.10 |

| Take Profit | 157.60 |

| Stop Loss | 153.00 |

| Key Levels | 149.20, 152.40, 154.10, 157.60 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 152.40 |

| Take Profit | 149.20 |

| Stop Loss | 153.20 |

| Key Levels | 149.20, 152.40, 154.10, 157.60 |

Current trend

The USD/JPY pair is correcting in a sideways trend at 153.33. The yen is retreating from its highs amid increasing pressure from the American dollar and poor expectations regarding macroeconomic reports due tomorrow at 01:50 (GMT 2).

Thus, according to preliminary estimates, September industrial production will increase from –3.3% to 0.9%. However, retail sales will decrease from 2.8% to 2.1%, continuing the negative trend since late summer because of accelerating consumer inflation, which has already caused monetary policy to tighten. At 05:00 (GMT 2), the Bank of Japan meeting will end. However, analysts assume that the interest rate will remain at 0.25%. Earlier, Finance Minister Katsunobu Kato said the government would monitor currency movements, hinting at the possibility of more interventions, and Economy Minister Ryosei Akazawa noted that a poor yen could put pressure on the economy, leading to a decline in real household income and private consumption.

The American dollar has pared yesterday’s gains and is holding at 104.10 in the USDX, as investors remain neutral amid yesterday’s ambiguous macroeconomic statistics. The October Conference Board consumer confidence index increased from 99.2 points to a high of 108.7 points. However, September JOLTS job openings fell from 7.861M to 7.443M, the lowest since 2021.

Support and resistance

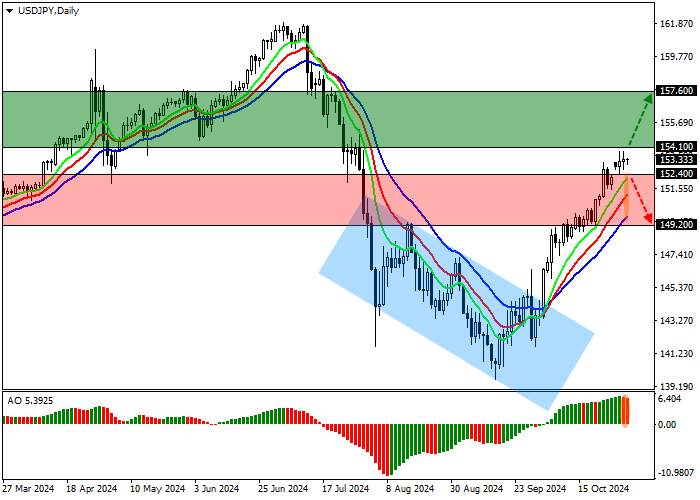

On the daily chart, the trading instrument is correcting upward after breaking out of the local channel of 145.00–139.00. Technical indicators maintain a stable buy signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming ascending bars in the buy zone.

Resistance levels: 154.10, 157.60.

Support levels: 152.40, 149.20.

Trading tips

Long positions may be opened after the price rises and consolidates above 154.10, with the target at 157.60. Stop loss is 153.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 152.40, with the target at 149.20. Stop loss is 153.20.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()