| Scenario | |

|---|---|

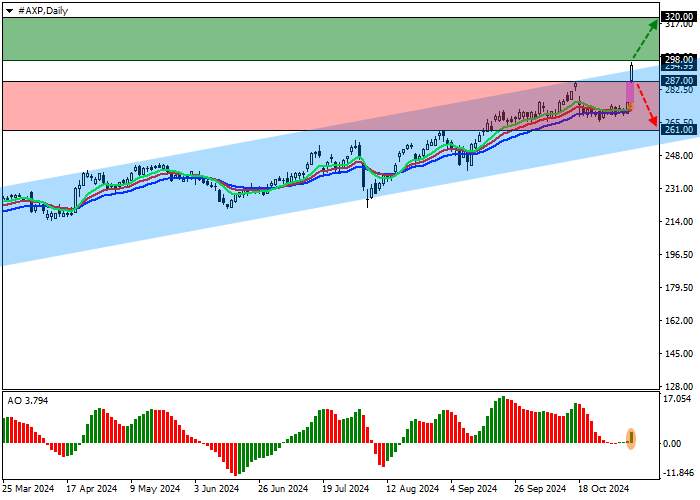

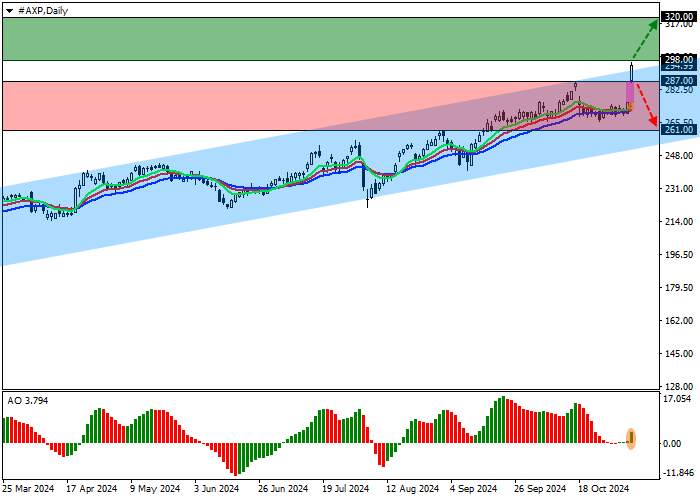

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 298.05 |

| Take Profit | 320.00 |

| Stop Loss | 290.00 |

| Key Levels | 261.00, 287.00, 298.00, 320.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 286.95 |

| Take Profit | 261.00 |

| Stop Loss | 295.00 |

| Key Levels | 261.00, 287.00, 298.00, 320.00 |

Current trend

Shares of American Express Co., one of the leading American multinational companies providing payment transaction services, are correcting at 294.00.

Leading analysts are revising their estimates regarding the prospects of the payment operator’s shares after the publication of the Q3 financial report. Robert W. Baird & Co. experts increased the target price from 215.00 to 240.00, maintaining the rating at underweight, basing the decision on increased estimates of activity for the year as a result of the operator’s revenue growth by 8.0% and an improvement in the forecast for the final earnings per share (EPS) to 13.75–14.05 dollars.

Thus, the Q3 revenue was corrected from 16.30B dollars to 16.64B dollars compared to 15.38B dollars last year, and earnings per share remained at 3.49 dollars against 3.30 dollars. The Board of Directors declared another quarterly dividend on non-cumulative preferred shares of Series D with a consolidated rate of 3.550% of 8.973K dollars per share, which will be paid on December 16 with the register cutoff on December 1.

Support and resistance

On the daily chart, the trading instrument is rising, retreating from the resistance line of the ascending channel, with dynamic boundaries of 290.00–255.00.

Technical indicators gave a buy signal: the EMA oscillation range on the Alligator indicator is directed upwards, fast EMAs are near the signal line, and the AO histogram forms ascending bars.

Resistance levels: 298.00, 320.00.

Support levels: 287.00, 261.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 298.00, with the target at 320.00. Stop loss — 290.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 287.00, with the target at 261.00 and stop loss 295.00

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()