| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 73.35 |

| Take Profit | 75.00, 78.12, 81.25 |

| Stop Loss | 71.85 |

| Key Levels | 59.38, 62.50, 65.62, 75.00, 78.12, 81.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 65.60 |

| Take Profit | 62.50, 59.38 |

| Stop Loss | 67.90 |

| Key Levels | 59.38, 62.50, 65.62, 75.00, 78.12, 81.25 |

Current trend

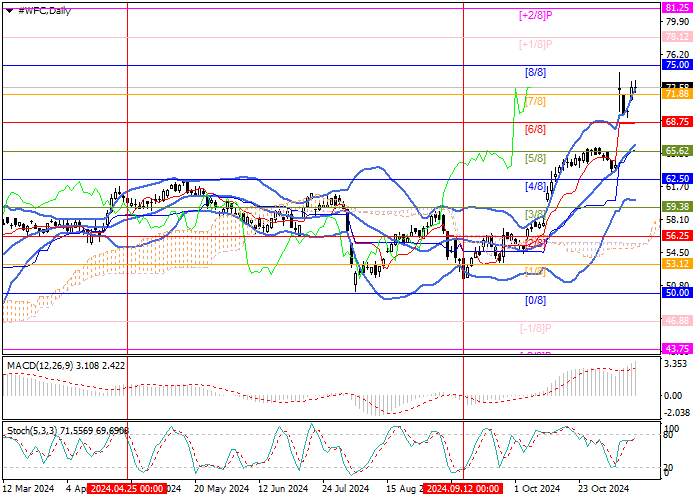

The shares of Wells Fargo & Co., one of the leading banking and insurance companies in the United States, have resumed active growth since mid-September: during this time, the price has turned from 53.12 (Murrey level [1/8]), moved into the positive part of the Murrey trading range and is currently trying to consolidate above 71.88 (Murrey level [7/8]) to continue the upward trend towards the targets of 75.00 (Murrey level [8/8]), 78.12 (Murrey level [ 1/8]) and 81.25 (Murrey level [ 2/8]). The key for the "bears" is seen at 65.62 (Murrey level [5/8]), supported by the central line of Bollinger Bands, the breakdown of which will ensure the resumption of the decline within the central Murrey channel to 62.50 (Murrey level [4/8]) and 59.38 (Murrey level [3/8]), but such a scenario is less likely.

Technical indicators confirm the continuation of the uptrend: Bollinger Bands and Stochastic are pointing downwards, MACD is growing in the positive zone.

Support and resistance

Resistance levels: 75.00, 78.12, 81.25.

Support levels: 65.62, 62.50, 59.38.

Trading tips

Long positions can be opened from the 73.30 mark with targets of 75.00, 78.12, 81.25 and a stop-loss around 71.85. Implementation period: 5–7 days.

Short positions should be opened below the level of 65.62 with targets of 62.50, 59.38 and a stop-loss around 67.90.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()