| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendations | BUY STOP |

| Entry point | 93770.00 |

| Take Profit | 97000.00, 100000.00 |

| Stop Loss | 91000.00 |

| Key levels | 81250.00, 87500.00, 93750.00, 97000.00, 100000.00 |

| Alternative scenario | |

|---|---|

| Recommendations | BUY LIMIT |

| Entry point | 81250.00 |

| Take Profit | 97000.00, 100000.00 |

| Stop Loss | 77000.00 |

| Key levels | 81250.00, 87500.00, 93750.00, 97000.00, 100000.00 |

Current dynamics

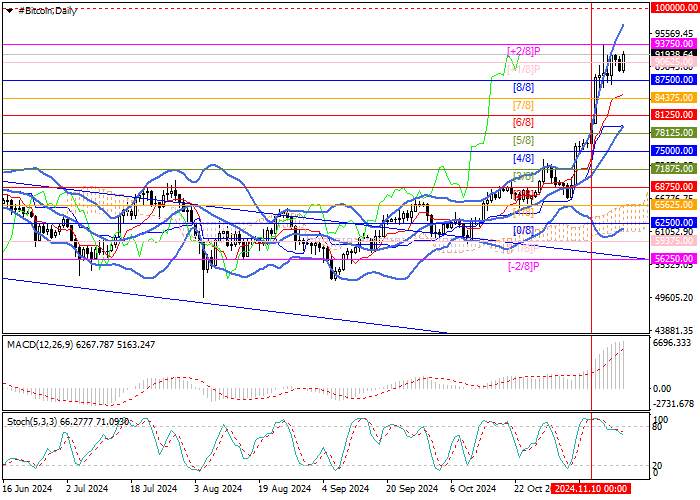

Last week, the BTC/USD pair continued its active upward dynamics and updated historical highs, rising above the 93400.00 mark, but then made a corrective rollback to the 87500.00 region (Murray level [8/8]) amid the increasing likelihood of the US Federal Reserve moving towards a slower easing of monetary policy.

Recall that on Thursday, the regulator’s head Jerome Powell said that continued economic growth, a strong labor market and high rates of increase in consumer prices give officials the opportunity to exercise caution in making decisions on further reduction in borrowing costs. These comments increased fears that the December interest rate cut by 25 basis points will be abandoned and the value will be adjusted more slowly next year. As a result, funds have begun to flow out of digital exchange-traded funds, which have amounted to $770.7 million over the past two sessions.

However, the price correction did not lead to a change in the current upward trend, and many experts still hope that in the medium term, quotes will reach 100,000.00. CryptoQuant platform analysts note that "whales" are actively accumulating tokens in anticipation of an increase in their value. In addition, the influx of stablecoins to cryptocurrency exchanges is increasing, which has historically been a sign of a rally in "digital gold". It should be noted that long-term investor interest in digital assets is still supported by political factors. Market participants hope that the representative of the Republican Party, Donald Trump, who was elected the new US President, will fulfill at least some of the promises made to the crypto community: a change in the head of the Securities and Exchange Commission (SEC) should not be expected before January next year, but there is some progress regarding the transfer of BTC to the strategic reserve. Last week, Pennsylvania Republican Mike Cabell introduced a bill in the state House of Representatives that would allow the Treasury to invest up to 10.0% of its budget in bitcoin to protect funds from economic instability. And over the weekend, Wyoming Senator Cynthia Lummis told Bloomberg that she is pushing for the Treasury to convert some of its gold reserves into BTC.

The long-term fundamental background remains positive for “digital gold” and the likelihood of further growth in its quotes remains.

Support and resistance levels

The instrument price is now close to the 93750.00 mark (Murray level [ 2/8]), consolidation above which will ensure continued growth to the targets of 97000.00 and 100000.00. If the 87500.00 mark (Murray level [8/8]) is broken downwards, a correction to the 81250.00 mark (Murray level [6/8], the middle line of Bollinger Bands) will be possible.

Technical indicators indicate a continuation of the current uptrend: Bollinger Bands are pointing upwards, MACD is increasing in the positive zone, and Stochastic is leaving the overbought zone.

Resistance levels: 93750.00, 97000.00, 100000.00.

Support levels: 87500.00, 81250.00.

Trading scenarios

Long positions can be opened above 93750.00 or when the price reverses around 81250.00 with targets at 97000.00, 100000.00 and stop losses at 91000.00 and 77000.00, respectively. Implementation period: 5-7 days.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()