Looking to enter the forex market with a small budget but unsure where to start? Don’t worry, minimum deposit forex brokers are the perfect solution for you! These platforms allow you to start trading with just a few dollars, so you don’t have to worry about high entry barriers. Whether you’re a beginner or a trader with a limited budget, low deposit brokers in 2025 will make it easy for you to get started. This article will explain why small capital can still succeed in the forex market, recommend trustworthy platforms like Ultima Markets, and provide practical guides from entry-level to hands-on trading. With just a few dollars and the right tools, you can begin your journey in this opportunity-filled market. Keep reading to find the best low deposit trading options that suit you!

Why Small Capital Can Still Succeed in Forex Trading

The forex market may seem like it requires a large amount of capital, but brokers with low minimum deposits have completely changed this perception. Why can these platforms allow small capital to trade easily? Here are a few key reasons:

- Low-Risk Entry: You can start trading with just a few dollars, and even if the market is volatile, your losses are still within a controllable range. For example, with a $50 investment, you can test strategies in real-time without worrying about financial pressure. This low-risk feature allows beginners to dip their toes into the market with confidence.

- Hands-On Learning: Unlike theoretical learning, low-deposit brokers allow you to accumulate real experience through small trades. You can operate personally, observe market changes, and gradually master trading techniques without the pressure of high-cost trial and error.

- Flexible Options: From $1 to $100, these brokers cater to various budget needs. Whether you want to experiment with small amounts or are ready to invest a bit more to test strategies, there's always a platform that suits your needs.

These advantages enable small capital to thrive in the forex market in 2025. The key is selecting the right broker, so every dollar you invest can be maximized. Now, let’s take a look at the top picks for 2025.

Recommended Minimum Deposit Forex Brokers for 2025

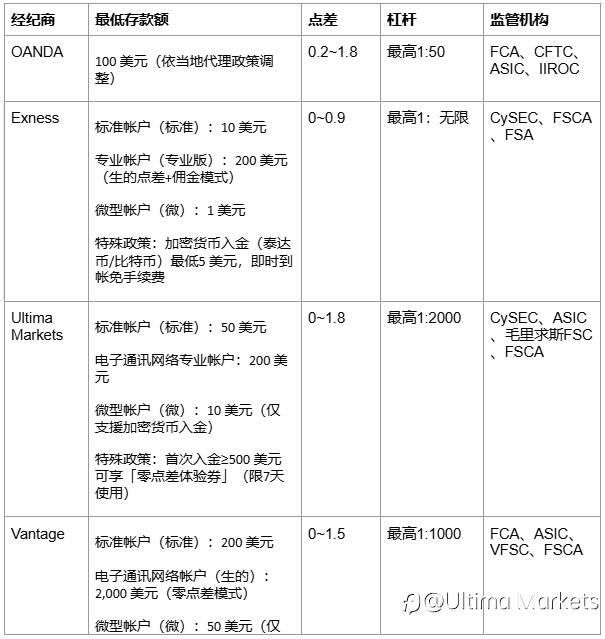

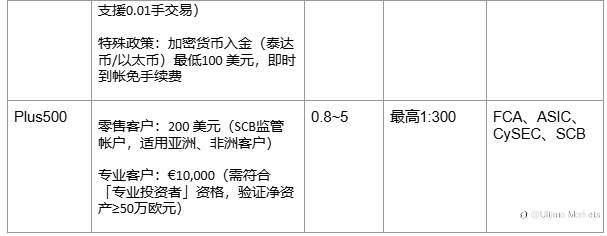

Choosing the right platform is the first step to success in small capital trading. We have compared five low-deposit brokers that are gaining attention in 2025: Ultima Markets, Exness, Vantage, OANDA, and Plus500. Below is a detailed comparison focusing on minimum deposits, spreads, fees, leverage, and regulation:

Broker

Minimum Deposit

Spread (EUR/USD)

Commission (Per Round Turn)

Leverage

Regulatory Authority

In the vast number of choices available, Ultima Markets stands out with its flexibility and beginner-friendly features:

- Low Minimum Deposit: You can open a standard account with just $50, which is more affordable than Plus500’s $100 and comparable to Vantage, but with higher leverage (1:2000 vs. 1:500).

- Trading Costs: The standard account has spreads starting from 1 pip with no commission, making it ideal for beginners. The ECN account has spreads starting from 0 pips, with a $3-$5 commission per lot, which is lower than Exness Raw’s $7 and Vantage’s $6, offering great value.

- Beginner Benefits: For first-time deposits of $500, you’ll receive a 7-day zero-spread voucher, allowing you to get familiar with the market in a low-cost environment. Additionally, free demo accounts and educational resources are provided to support beginners.

- Regulatory Assurance: Ultima Markets is regulated by both CySEC and ASIC, ensuring your funds are secure and allowing you to trade with peace of mind.

In comparison, Exness attracts ultra-low-budget traders with a $10 minimum deposit, but their low-spread accounts require $200; OANDA, while having no minimum deposit requirement, has higher spreads and commissions. Ultima Markets strikes the perfect balance between cost and functionality, making it the ideal choice for small capital trading in 2025.

How Do Minimum Deposit Brokers Work?

After reading the recommendations, you may wonder: how do these low-deposit brokers make small capital trading possible? Simply put, the minimum deposit refers to the smallest amount required to open a forex account, typically between $1 and $100. These brokers operate in the following ways:

- Low-Threshold Design: By setting extremely low deposit requirements (e.g., Ultima Markets’ $50), they attract beginners and testers to enter the market.

- Leverage Tools: Brokers offer high leverage (e.g., 1:2000) that enables small amounts of capital to participate in larger trades, amplifying potential returns (but also increasing risk).

- Technical Support: Brokers provide demo accounts and educational resources to help traders familiarize themselves with the platform and market before engaging in real trading.

This model works like a low-cost ticket, allowing you to experience the allure of forex trading without needing a large capital outlay. Once you understand how it works, let’s take a look at how to get started practically.

How Beginners Can Get Started: A Practical Guide to Forex Trading

With the right broker, getting started with forex trading isn’t difficult. Here’s a simple guide for beginners using Ultima Markets:

- Registration and Funding: Visit Ultima Markets to open a live account or download the app. Fill in basic information and complete identity verification in just a few minutes. You can deposit funds through credit card, bank transfer, or cryptocurrency, with a minimum of $50, making it quick and convenient.

- Choose Assets and Place Orders: The platform offers a variety of products like forex, precious metals, indices, etc. After selecting your trading asset, set the position size, leverage (up to 1:2000—though beginners should be cautious), and apply stop-loss and take-profit orders. Then, click "Buy" or "Sell" to place the order.

- Practice and Monitor: Not ready for real money? Use a free demo account to practice in a simulated real-market environment. Once you’re ready to trade live, you can monitor your positions in real-time and close them to lock in profits or stop losses.

Ultima Markets offers 24/5 customer support to answer any questions, ensuring you have a smooth start. The entire process—from registration to trading—is simple and intuitive, making it ideal for beginners.

Three Key Tips for Choosing Low Deposit Brokers

With so many options available, how can you choose the best low-deposit forex broker for you? Here are three key tips to help you make an informed decision:

- Regulatory Security: Choose a platform regulated by reputable authorities, such as FCA, ASIC, or CySEC. Ultima Markets is regulated by both CySEC and ASIC, ensuring the safety of your funds and providing peace of mind during trading.

- Transparent Costs: Spreads and commissions directly affect your profits. Ultima Markets’ standard account has no commission, with spreads starting at 1 pip. The ECN account has spreads starting from 0 pips with $3-$5 commissions per lot, offering transparent and competitive costs, suitable for various trading styles.

- Efficient Service: Fast deposits and withdrawals, along with excellent customer support, are crucial for beginners. Ultima Markets supports instant deposits, with withdrawals completed within 1-3 days. Their 24/7 customer service is always available to help, providing an efficient experience.

Based on your budget and goals, try testing a few platforms with demo accounts to get a feel for the actual experience before making a decision.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()