Oil prices fell on Friday and were set to drop for a second week on concerns prolonged trade war between the US and China, the world's largest economies, will crush crude consumption.

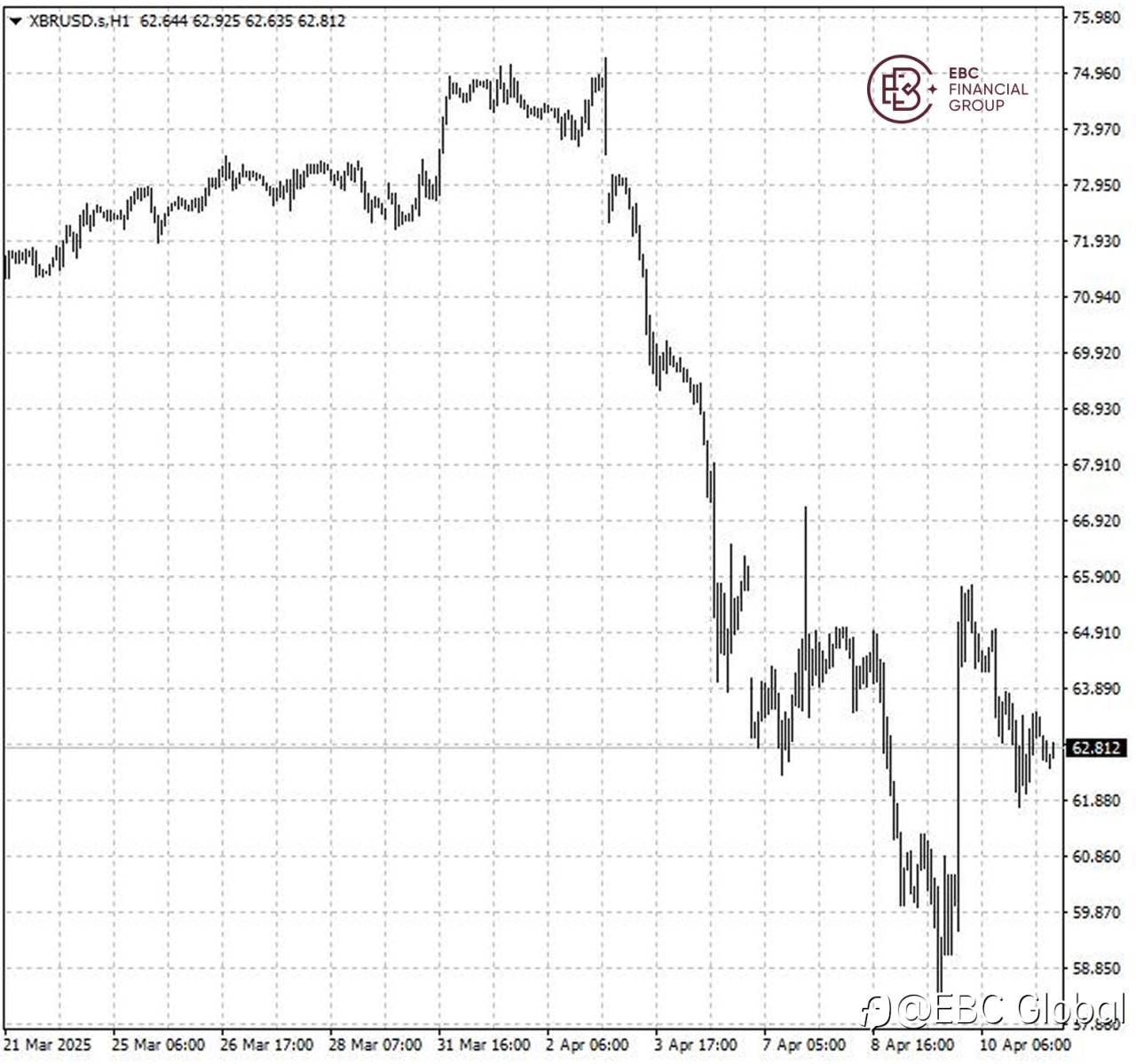

Brent is set to fall 4% this week, adding to an 11% drop in the prior week, while WTI is set to decline 3.8%, after also falling 11% in the previous week. Risk sentiment is souring on uncertainties around supply chain.

An all-out trade war could have large repercussions for producers like China, which have to seek new markets in the face of weak domestic consumption.

Slower growth and hotter inflation will leave some governments struggling even more to pay down the world's record $318 trillion debt load and find money for budget priorities such as defence, climate action and welfare.

The EIA on Thursday lowered its global economic growth forecasts and warned that tariffs could weigh heavily on oil prices, as it slashed its US and global oil demand forecasts for this year and next.

In the US, crude inventories rose by 2.6 million barrels last week, the agency said, compared with analysts' expectations in a Reuters poll for a 1.4-million-barrel rise.

Brent crude has shown a bearish pennant pattern, suggesting there could be more pains ahead. As such we see it retest $62 in the upcoming sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()