MetaTrader 5 (MT5) offers multi-asset trading, meaning traders can trade across various financial markets from a single platform, such as forex, stocks, indices, commodities, and cryptocurrencies.

Multi-asset trading enables traders to diversify their portfolios and hedge risks while simultaneously taking advantage of different market conditions. With the growing interconnectivity of financial markets, traders can leverage correlations between various asset classes.

For example, a trader might short stock indices while going long on gold during market downturns or trade forex pairs influenced by commodities, such as CAD/USD with oil prices.

Why MetaTrader 5 is Ideal for Multi-Asset Trading

MetaTrader 5 (MT5) is a powerful, multi-asset trading platform designed to meet the demands of both retail and institutional traders. It expands upon the limitations of MetaTrader 4 (MT4) by offering access to a broader range of financial markets, improved execution models, and advanced analytical tools.

The key features that make MT5 ideal for multi-asset trading are:

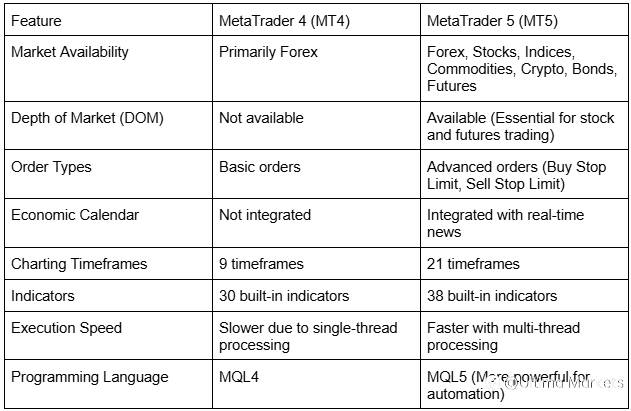

- Support for Multiple Markets – MT5 allows traders to access forex, stocks, indices, commodities, cryptocurrencies, and bonds from a single account, making it a trustworthy multi-asset platform.

- Depth of Market (DOM) – Unlike MT4, MT5 offers Depth of Market (DOM), essential for stock and futures trading. This feature allows traders to see available liquidity at different price levels.

- Advanced Order Types – MT5 provides additional order types, such as Buy Stop Limit and Sell Stop Limit, applicable for trading volatile assets.

- Improved Execution Speed – The platform is designed for fast execution, critical for multi-asset traders, especially those involved in high-frequency trading or scalping.

- Comprehensive Charting & Indicators – MT5 offers 21 timeframes, 38 built-in indicators, and multiple charting tools to help traders analyse different asset classes.

- Automated Trading Across Assets – Traders can use Expert Advisors (EAs) and trading robots to automate strategies for different markets, reducing manual workload.

- Economic Calendar & News Integration – MT5 provides real-time news and an economic calendar to help traders make informed decisions based on macroeconomic events.

- Risk Management & Portfolio Diversification – With access to multiple assets, traders can spread risk across different markets, reducing exposure to a single asset class.

Benefits of Multi-Asset Trading

Multi-asset trading brings many benefits to traders. Instead of being limited to one market, traders can diversify their portfolios and take advantage of price movements across multiple asset classes.

Some of its key benefits are:

- Diversification – Trading multiple assets helps reduce risk by spreading exposure across different markets.

- Hedging Opportunities – Traders can use correlated assets to hedge positions. For example, a trader holding stocks might hedge with gold or bonds during market downturns.

- Increased Trading Opportunities – Different markets have different volatility cycles. Multi-asset trading allows traders to find opportunities in various market conditions.

- Better Risk Management – With access to various instruments, traders can manage risk exposure more effectively by adjusting positions across multiple assets.

Differences Between MT4 and MT5 for Multi-Asset Trading

While MetaTrader 4 (MT4) remains popular for forex trading, it has significant limitations regarding multi-asset trading. MetaTrader 5 (MT5) was developed as a more advanced and versatile platform to accommodate a broader range of financial instruments.

Why MT5 is Better for Multi-Asset Trading?

- Support for Centralized Exchanges: MT5 is built to handle exchange-traded assets like stocks, futures, and bonds, whereas MT4 is designed mainly for decentralised forex trading.

- Improved Order Management: MT5 provides additional order types and better execution models, making it suitable for trading assets with different liquidity structures.

- Better Performance: The platform is faster and more efficient, reducing execution delays critical for high-volatility assets.

Asset Classes Available on MetaTrader 5

MetaTrader 5 (MT5) is a trustworthy multi-asset trading platform that gives traders access to a wide range of financial instruments. Unlike MT4, which mainly focuses on forex, MT5 supports trading in forex, stocks, indices, commodities, cryptocurrencies, and bonds. This makes it a versatile platform for traders looking to diversify their portfolios and capitalise on different market conditions.

1. Forex Trading

Forex (foreign exchange) trading involves buying and selling currency pairs. It is the most liquid market in the world, operating 24 hours a day, five days a week.

MT5 provides traders access to over 80 currency pairs, including majors (EUR/USD, GBP/USD, USD/JPY), minors, and exotics. It also offers advanced charting with 21 timeframes for precise technical analysis and access to automated trading with Expert Advisors (EAs) for algorithmic strategies.

2. Stock Trading

MT5 allows traders to invest in individual company stocks (equities). Unlike forex, which is decentralised, stocks are traded on centralised exchanges like NYSE, NASDAQ, and the London Stock Exchange (LSE).

MT5 offers traders access to global stocks like Apple, Tesla, Microsoft, and Amazon. The platform provides access to rental-time stock market data and fundamental analysis tools. Traders can also use Depth of Market (DOM) to see available liquidity and order book levels and place limit orders, stop-limit orders, and market orders for precise execution.

3. Indices Trading

Indices represent the performance of a group of stocks from a particular sector or country. They are popular for traders who want broad market exposure without buying individual stocks.

Traders can trade major indices like NAS100 (Nasdaq 100), HK50 (Hang Seng Index), GER30 (DAX 30), and DJI30 (Dow Jones Industrial Average) on MT5.

4. Commodities Trading

Commodities are physical assets that include metals, energy products, and agricultural goods. They are traded on futures exchanges and are often used for hedging and speculation.

MT5 allies traders to trade precious metals, like gold (XAU/USD) and silver (XAG/USD), energy commodities, like crude oil (WTI, Brent) and natural gas, and agricultural commodities like wheat, coffee, and corn. They can even use fundamental analysis tools to track supply-demand trends and geopolitical risks.

5. Cryptocurrency Trading

Cryptocurrencies are digital assets that operate on decentralised blockchain networks. They are highly volatile and provide unique trading opportunities. Although this asset class is relatively new, demand for trading cryptocurrencies has exploded drastically recently. Unlike traditional markets, crypto trading is available 24/7.

On MT5, traders can trade significant cryptocurrencies like Bitcoin (BTC/USD), Ethereum (ETH/USD), Ripple (XRP/USD), and Litecoin (LTC/USD). Traders can also access high-leverage options for crypto CFD trading.

6. Bonds & Futures Trading

MT5 also supports trading in government and corporate bonds and futures contracts for commodities, indices, and interest rates. These instruments are often used for hedging against inflation and market risks.

Traders can trade government bonds such as US Treasury Bonds (T-Notes, T-Bonds) on MT5. They can also speculate on interest rate futures to hedge against changes in central bank policies and access commodity futures to trade oil, gold, and agricultural products.

MetaTrader 5 (MT5) is a powerful and versatile trading platform that enables traders to access and manage multiple asset classes efficiently. With advanced charting tools, automated trading capabilities, comprehensive risk management features, and real-time market data, MT5 provides everything needed for successful multi-asset trading. Whether trading forex, stocks, commodities, or indices, MT5 offers the flexibility and functionality required to adapt to different market conditions. By leveraging its analytical tools, refining trading strategies, and avoiding common mistakes, traders can enhance their performance and achieve consistent success. Mastering MT5 is key to confidently and precisely navigating today’s dynamic financial markets.

Trade with Ultima Markets

Ultima Markets is a fully licensed broker and a multi-asset trading platform offering access to

250+ CFD financial instruments, including Forex, Commodities, Indices and Shares. We

guarantee tight spreads and fast execution. Until now, we have served clients from 172

countries and regions with our trustworthy services and well-built trading systems.

Ultima Markets has achieved remarkable recognition in 2024, winning prestigious awards

such as the Best Affiliates Brokerage, Best Fund Safety in Global Forex Awards, and

the Best APAC CFD broker in Traders Fair 2024 Hong Kong. As the first CFD broker to join

the United Nations Global Compact, Ultima Markets underscores its commitment to

sustainability and the mission to advance ethical financial services and contribute to a

sustainable future.

Ultima Markets is a member of The Financial Commission, an international independent

body responsible for resolving disputes in the Forex and CFD markets.

All clients of Ultima Markets are protected under insurance coverage provided by Willis

Towers Watson (WTW), a global insurance brokerage established in 1828, with claims

eligibility up to US$1,000,000 per account.

Open an account with Ultima Markets to start your index CFDs trading journey.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()