In financial markets, PIPS (points) are a crucial unit for measuring price fluctuations, particularly in forex trading. Accurately understanding what PIPS are and how to calculate them is fundamental for every trader in terms of developing strategies, managing risks, and evaluating profit potential. This article will guide readers through the definition of PIPS, calculation methods, and their practical application in various assets, from basic knowledge to advanced techniques. It should be noted that while pip value and spreads are also important concepts in trading, this article will focus on the definition and real-world application of PIPS, with later chapters addressing the roles and calculation methods of pip value and spreads for a more detailed understanding.

Definition and Basic Concept of PIPS

PIPS, or "points," typically refer to the smallest unit of price movement in financial products. In the forex market, a common definition is that when the fourth decimal place in a currency pair quote changes, it represents a movement of one PIP. For example, if the EUR/USD quote rises from 1.1050 to 1.1051, it means the market price has moved by one PIP. Although this small price change may seem insignificant in value, it is an essential tool for precisely recording market price fluctuations.

By understanding PIPS, traders can more intuitively grasp market trends, making it easier to set stop-loss points, calculate risks, and predict potential profits. Moreover, the concept of PIPS is not limited to forex trading; it can also be extended to other asset markets, serving as a universal standard for assessing price movement magnitude.

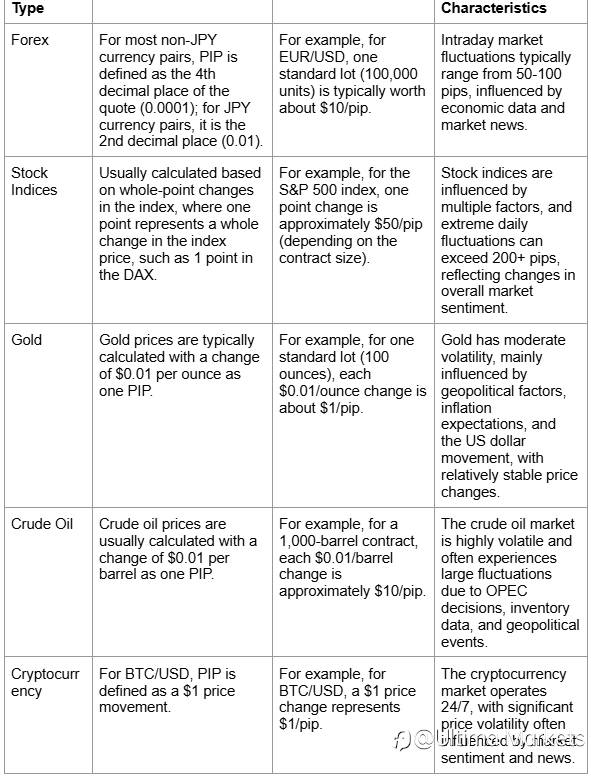

Comparison of PIPS Across Different Assets

PIPS Calculation Method and Practical Application

1. PIPS Calculation Method

In financial markets, PIPS are the smallest unit of price movement, and the calculation method varies depending on the asset type. Below is the basic calculation process and formula for the forex market:

- Calculation Formula:

1.Pip Value Calculation Formula

The value of each PIP can be calculated using the following formula:

Pip Value = (PIP Size / Current Exchange Rate) × Trade Units

For example, in the EUR/USD currency pair, assuming the current exchange rate is 1.1050 and the trader holds one standard lot (100,000 units):

- PIP Size: 0.0001

- Pip Value = (0.0001 / 1.1050) × 100,000 ≈ $9.05

In actual trading, it is typically agreed to be $10/pip, although the specific value may fluctuate slightly depending on market conditions.

2.PIPS Calculation for Other Assets

- Gold: Gold prices move by $0.01 per ounce as one PIP, and for a standard lot of 100 ounces, the pip value is about $1.

- Crude Oil: Crude oil prices move by $0.01 per barrel as one PIP, and for a contract size of 1,000 barrels, the pip value is about $10.

- Cryptocurrency: For BTC/USD, if a $1 price change represents one PIP, then the pip value is $1.

- Process:

1.Confirm Asset Type and PIP Definition: Understand the smallest price movement unit based on the asset being traded.

2.Determine Trade Size: For forex, a standard lot is typically 100,000 units.

3.Calculate Pip Value: Apply the relevant calculation formula to determine the monetary value of each PIP.

4.Assess Risk and Potential Profit/Loss: Based on expected price fluctuations (measured in pips), calculate possible losses or gains, providing the basis for risk management and strategy adjustments.

2. Practical Application of PIPS

Using PIPS for trading risk management and decision-making is an essential tool for traders. Below is a specific example showing how PIPS can be applied to control risk and plan trading strategies.

- Case Background:

Assume a trader is trading the EUR/USD currency pair, with the current exchange rate at 1.1050, and decides to open a position of one standard lot.

- Calculating Pip Value:

Based on the formula mentioned earlier, the value of each PIP is about $10.

- Setting Risk Parameters:

- Stop-Loss Setting:

for the trader sets the stop-loss point at 50 pips, the maximum loss will be:

50 pips × $10/pip = $500.

This value allows the trader to limit the loss within an acceptable range when the market moves unfavorably.

- Take-Profit Setting:

If the trader expects the price to rise by 80 pips, the potential profit will be:

80 pips × $10/pip = $800.

This profit/loss ratio helps the trader assess the risk and reward of entering the trade, ensuring the strategy has a positive expected value.

- Risk Management Application:

Through the above calculations, traders can determine the appropriate position size based on the value of each PIP. For example:

- If market volatility increases or the trader becomes more cautious about risk, they can choose to reduce the position size to lower the overall risk of each trade.

- On the other hand, if market volatility is relatively stable, traders can increase their position size to enhance profit potential.

- Decision Making:

Once the value of each PIP is understood, traders can make more accurate trading decisions based on technical analysis, fundamental data, and market sentiment. For example:

- When expecting the market to break a certain technical support or resistance level, the trader can use PIPS calculations to set entry or exit points.

- Before news announcements or the release of important economic data, traders can use PIPS to predict the potential price fluctuation range and choose more reasonable stop-loss and take-profit strategies.

In summary, by calculating the value of each PIP in detail, traders can not only accurately estimate potential profits and losses but also adjust trading strategies flexibly based on market fluctuations and personal risk tolerance. This PIPS-based scientific calculation and application method provides solid data support and risk management foundations for successful trading operations.

Advanced Concepts: Pip Value and Spread

1. Pip Value

Pip value refers to the monetary value that each PIP represents in actual trading, directly affecting the trader's profit and loss calculations as well as risk management. Specifically, the pip value depends on the size of the trading contract and the current market price. The calculation formula is typically:

Pip Value = (PIP Size / Current Price) × Trade Units

For example, in forex trading, with the EUR/USD pair and assuming the current exchange rate is 1.1050 and the trader is operating a standard lot (100,000 units), the value of each PIP (0.0001) would be approximately $10. When the trade size changes (such as a mini lot or micro lot), the pip value will adjust accordingly. Mastering pip value helps traders set stop-loss and take-profit levels based on personal risk tolerance and perform precise money management.

2. Spread

The spread refers to the difference between the bid price and the ask price, representing the implicit cost traders bear in each transaction. The size of the spread is primarily influenced by the following factors:

- Market Liquidity: Highly liquid markets typically have lower spreads; conversely, markets with insufficient liquidity tend to have wider spreads.

- Supply and Demand: When market demand surges or supply is insufficient, spreads may widen.

- Broker Pricing Strategy: Different trading platforms or brokers' pricing mechanisms can also result in spread differences.

The size of the spread is directly related to trading costs, especially for day traders, where a high spread might place the trade in an unfavorable position right at the opening, affecting profitability. Therefore, understanding and monitoring the spread is a critical element in formulating an effective trading strategy.

Ultima Markets, with trading costs as low as 0.0 pips and low or zero commission, is favored by many global investors. Ultima Markets offers 24-hour two-way trading and a free demo account with no deposit required, allowing you to practice trading anytime, anywhere, and familiarize yourself with the platform. It also provides real-time trading strategies to help you seize trading opportunities!

Regarding fund safety, Ultima Markets is regulated by several internationally recognized institutions, including the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). Clients' funds are kept segregated in one of Australia’s four major banks, Westpac. Additionally, all UM clients are covered by Willis Towers Watson (WTW), a global insurance broker established in 1828, with compensation coverage up to $1 million per account.

How to Help Understand the True Meaning of PIPS

The advanced concepts of pip value and spread enrich the understanding of PIPS from different perspectives:

- Pip value enables traders to clearly understand the actual currency change represented by each PIP, helping to accurately calculate potential profits and losses and adjust position sizes.

- The spread helps traders understand the market entry cost, preventing high spreads from eroding expected profits.

By combining these two aspects of analysis, traders can not only more accurately assess market volatility but also formulate more scientific risk management and trading strategies based on different asset types and market conditions. These advanced concepts ultimately help improve trading efficiency and profitability, truly reflecting the core value of PIPS in trading.

FAQs

- How do you correctly calculate the value of each PIP?

The method for calculating the value of each PIP varies slightly across different assets, but the basic formula is based on the PIP size, current price, and trade units. For example:

- In the forex market, if the EUR/USD quote is 1.1050, for a standard lot (100,000 units), the value of each PIP (0.0001) is approximately $10.

It is recommended that traders confirm the specific definition and calculation formula of the asset they are trading before opening a position and perform precise calculations based on their position size.

- Why do the PIP definitions and pip values differ across different assets?

Each asset market sets its own minimum price movement unit based on the quote format and market characteristics. For example:

- In forex, non-JPY currency pairs are calculated to the fourth decimal place, while JPY currency pairs are calculated to the second decimal place;

- Gold uses $0.01 per ounce and crude oil uses $0.01 per barrel as the standard;

- Cryptocurrency may define a PIP as a $1 movement.

Understanding these differences helps traders adjust strategies based on different market characteristics.

- How can you use PIPS for risk control during market volatility?

When the market is highly volatile, PIPS is an intuitive tool that helps traders set reasonable stop-loss and take-profit levels. Experts suggest:

- Set stop-loss points based on historical volatility ranges to ensure risk control during extreme market conditions;

- Regularly adjust position sizes to avoid excessive losses caused by short-term market fluctuations.

- Do all brokers use the same PIP definition?

Not all brokers use the same PIP definition. Different platforms or brokers may have slight differences in their pricing rules. Traders should carefully read the trading specifications to confirm the exact PIP definition and calculation method to avoid misunderstandings when trading across platforms.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()