China's economy beat forecasts across the board in the first quarter, as policy support boosts GDP and domestic demand. But tariff headwinds will likely necessitate more monetary and fiscal easing. We expect China to take additional measures to meet this year’s “around 5%” growth target

China's first-quarter GDP showed a strong start to the year

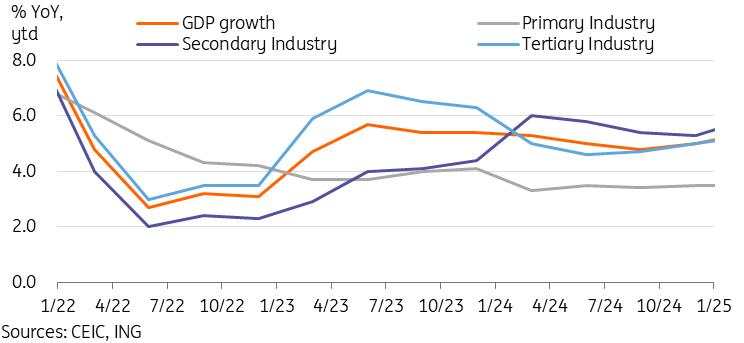

China's first-quarter growth registered a stronger-than-expected 5.4% year on year, beating our 5.3% forecast and market expectations for 5.2% growth. The economy is off to a much-needed strong start in 2025, as second-quarter growth will likely take hits from the sharp escalation of President Trump’s trade war.

Once again, the manufacturing sector supported secondary industry growth of 5.9% YoY, the highest level since the first quarter of 2024. Moving forward, the trade-war impact on manufacturing will be watched closely to see if China’s overcapacity problem gets worse. Despite strong first-quarter manufacturing activity, we saw the industrial capacity utilisation rate slumped from 76.2% to 74.1%.

The secondary industry has now outpaced the tertiary industry growth for five straight quarters. With manufacturing likely to take a hit from tariffs, China’s ability to maintain solid growth moving forward could depend on the tertiary industry helping to pick up the slack.

This year's policy will be focused on supporting domestic demand. One important aspect will be building out the services sector, including childcare and elderly care and so-called "life services" like catering, domestic services, healthcare and tourism. We will see if these efforts bear fruit in the coming quarters.

China 1Q25 GDP showed a strong start to the year

China's property prices edge closer toward a trough

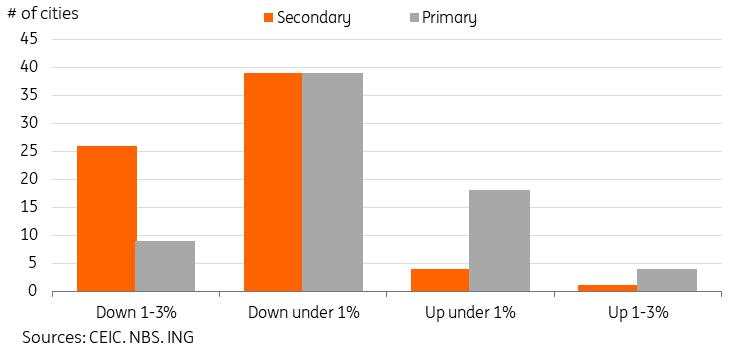

China's 70-city property price data saw a smaller sequential decline in both new home and used home prices in March, with prices down -0.08% and -0.23% month on month, respectively.

Despite continued declines, the data once again offers some reasons for optimism. For example, 29 cities saw new home prices stable or increasing, while 14 saw used home prices stable or rising.

In the new home market, 18 cities eked out gains of under 1% in the first quarter, while five saw prices rise over 1%. On the flip side, 39 cities saw price declines of under 1%, while nine saw a price drop of over 1%. The used-home market showed a slightly weaker picture, with four cities seeing price gains of under 1%, one with prices rising more than 1%, 39 with price drops under 1%, and 26 with prices dropping more than 1%. No city saw prices drop more than 2%.

This data suggests that property prices are in the process of establishing a trough.

Amid China's attempt to increase confidence and boost domestic demand, we believe that stabilising the property market remains a paramount priority. It’s difficult to imagine consumers spending confidently as long as their biggest asset continues to lose value every month. March data should be seen as another small step in the right direction.

More cities are starting to see prices edge up

Strong beat in retail sales showed impact of trade-in policies

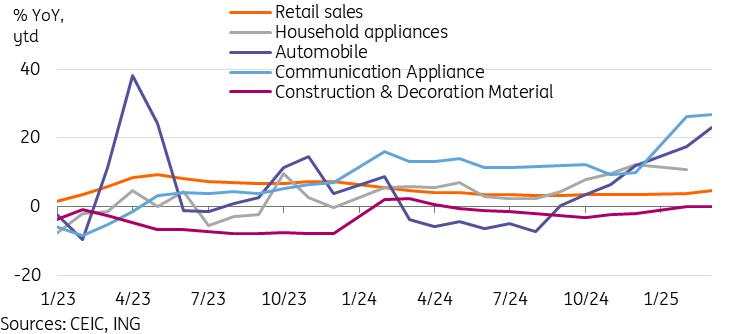

Retail sales accelerated to 5.9% YoY in March, up from 4.0% YoY in the first two months of the year. This is a significant beat from market forecasts for a smaller uptick to 4.3% YoY, and represents the highest level since 2023, a year which benefited from base effects from the pandemic. Over the first quarter, retail sales grew 4.6% YoY.

We are seeing a clear impact from the trade-in policy in the retail sales data. The trade-in policy beneficiary categories, particularly automobiles and household appliances in 2024, were expanded at the start of the year to include more consumer electronics. These include laptops, smartphones, home decoration and renovation materials. Most categories saw growth far eclipsing headline retail sales growth, with household appliances (35.1%) and communication equipment (28.6%) two clear standout categories. Auto sales also managed a respectable 5.5% YoY growth in March.

The "eat, drink, and play" theme continued to see above-average growth, with catering (6.8%), alcohol & tobacco (8.5%), and sports and recreation (26.2%) all seeing solid gains.

The non-beneficiary categories of discretionary consumption generally underperformed. The exceptions were gold and jewelry, which saw growth bounce back to 10.6% YoY.

Trade-in policy is having a clear impact on consumption

Value-added of industry hit highest level since 2021

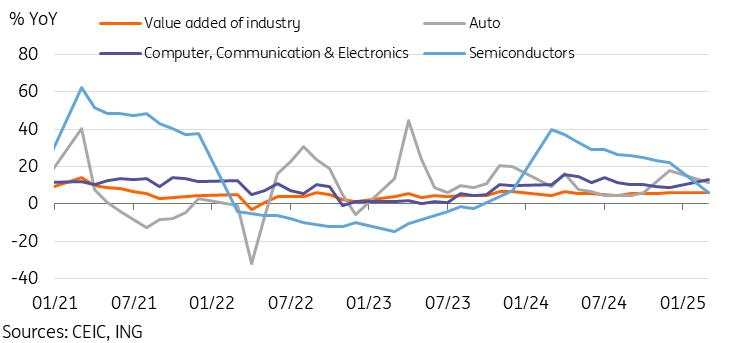

The value-added of industry also surprised to the upside, accelerating to 7.7% YoY from 5.9% YoY in the first two months of the year. This was the highest rate since the second quarter of 2021.

Manufacturing grew a solid 7.9% YoY on the month, with hi-tech manufacturing, in particular, outperforming at 10.7% YoY. By product output, we saw strong growth in power generation equipment (107.2%), new energy vehicles (40.6%), and industrial robots (16.7%). Semiconductors (9.2%), smartphones (7.0%), and computer equipment (7.8%) saw growth closer to the aggregate level.

Moving forward, the tariff shock is expected to have a spillover effect on manufacturing. Strengthening domestic demand and seeking alternative export destinations will help offset some of the impact. But manufacturing is likely to take a hit, nonetheless. On the brighter side, the US is not a major-end destination for many of the products seeing the fastest growth.

Value added of industry hit highest level since 2021 as hi-tech manufacturing ramps up

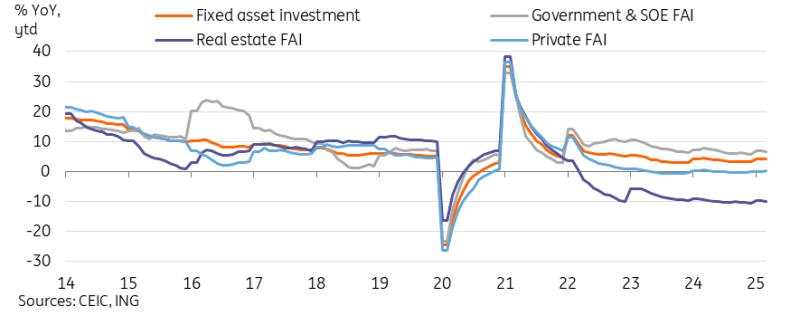

Fixed-asset investment edged up as private sector resumed investment

Fixed asset investment (FAI) surprised on the upside, though to a smaller degree compared to retail sales and industrial production. FAI rose 4.2% YoY, year to date, in 1Q25, up from 4.1% in the first two months of the year. One reason was a slight recovery of private investment, which rose to 0.4% YoY ytd. Private sector FAI growth had been flat or in YoY contraction since July 2024. This helped offset public sector FAI slowing to 6.5% YoY from 7.0%.

Manufacturing FAI continued to lead the way, with 9.1% YoY ytd growth. This category continues to benefit from policies to support equipment renewal. It’s also part of a longer-term story of China upgrading its manufacturing infrastructure as it moves up the value-added ladder.

Fixed-asset investment rebounded as private sector FAI growth turned positive

First quarter data an encouraging start but more will need to be done to hit this year's growth level

Stronger than expected March data is no doubt a welcome sign for Chinese policymakers, and offers a bit of a buffer for this year's goal to achieve around 5% GDP growth.

Moving forward, the sharp escalation of tariffs will no doubt begin to have a greater impact on activity data. The April purchasing managers’ index (PMI), data out a few weeks from now, is likely our first official look at how the impact is unfolding.

The March data shows positive signs that current efforts, namely the trade-in policy and the equipment renewal policy, are having a positive impact on domestic demand. However, assuming US tariffs remain in place for some time and the external demand picture deteriorates more noticeably in the coming months, it's likely that more policy support will be needed.

This expected external drag, combined with continued deflation pressures, presents a strong case for monetary policy easing. Last year's experience showed that bundled stimulus measures tend to have a stronger impact on markets. However, we observe that many voices continue to caution against rate cuts in the interest of currency stabilization. So, it’s possible that a reserve requirement ratio (RRR) cut could come first. We continue to expect 30bp of rate cuts and 100bp of RRR cuts this year.

The upcoming Politburo meeting, expected to take place toward the end of this month, could be a platform for announcing further stimulus measures as well.

Read the original analysis: China’s posts solid growth, but more support likely needed to meet 5% target

作者:ING Global Economics Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()