Outlook

Do we have US-China de-escalation or not? It’s hard to tell BUT WE SAY NO. Reuters reports “China has exempted some U.S. imports from its 125% tariffs and is asking firms to identify critical goods they need levy-free, according to businesses notified, in the clearest sign yet of Beijing's concerns about the trade war's economic fallout.”

This may be incorrectly written. If we understand it, China is considering exempting and has asked companies to make lists, but nothing has actually been exempted yet. Note that Bloomberg has the same story.

More from Reuters: “The dispensation, which follows de-escalatory statements from Washington, signals that the world's two largest economies were prepared to rein in their conflict, which had frozen much of the trade between them, raising fears of a global recession.

“Beijing's exemptions - which business groups hope would extend to dozens of industries - pushed the U.S. dollar up slightly and lifted equity markets in Hong Kong and Japan.

‘As a quid-pro-quo move, it could provide a potential way to de-escalate tensions,’ said Alfredo Montufar-Helu, a senior adviser to the Conference Board's China Center, a think tank.

“But, he cautioned: ‘It’s clear that neither the U.S. nor China want to be the first in reaching out for a deal.’ China has not yet communicated publicly on any exemptions.

The Commerce Dept is indeed collecting information from Chinese importers. We are citing the story at length because the world thinks China blinked. It didn’t.

On another front, we have to be wary of comments by Fed officials. They have distracted more than informed over the years. This time Bloomberg features Cleveland Pres Hammack saying the Fed could cut rates as early as June if it has clear evidence. Gov Waller said he would support a cut if tariffs result in job losses. So far, no cigar. Jobless claims yesterday rose a mere 6k to 222 k, while continuing claims fell.

Trump is on a plane to Italy for the pope’s funeral. One of his favorite stunts is to make rash remarks at the top of the airplane steps before descending. (He thinks the funeral is about him and not the actual subject.) We bet $10 that he claims Pres Xi called him and he is making a deal with China right away. He may also claim deals with Russia on Ukraine and with Iran. He wants to be the star of this drama.

Here's the problem: nearly none of will be true. But equity markets and probably some others (FX) want relief so badly that they will believe him, or at least go with the flow of wild US asset buying at recently lowered prices.

But tigers and stripes. At some point, if he doesn’t get his way, he is going to lash out again. This means another whipsaw, first a higher dollar/S&P/yields and then another crash. The timing of this is impossible to predict. But it’s a familiar pattern and we should not forget it.

Forecast

We predicted a typical Trump temper-tantrum yesterday and today we expect a false victory dance. It’s not out of the question that markets believe a China deal is imminent and go whole-hog dumping stagflation scenarios. After all, the US economy is robust and resilient. Get rid of the worst of the Trump bad policies, and we’re all right, Jack.

This could well be the outcome down the road but it is NOT on the table yet.

Beware going with the crowd that believes a falsehood. The US does not have a deal with China. China is only “considering” exemptions and exemptions are not yet being offered to the US as a bargaining ship. This story is not ending soon and has only just begun.

If we get a dollar rally, stand aside unless you can sit in front of the monitor, have nimble fingers and can trade the 10-minute timeframe. Either Trump or China can change the narrative in a minute.

Tidbit: Every single poll., and there are five of them, show the public disapproves of every single policy Trump has put out, including a 91% disapproval of thumbing his nose at the Supreme Court. The anti-Trump league is basking in it. But polls are not meaningful unless they change conduct.

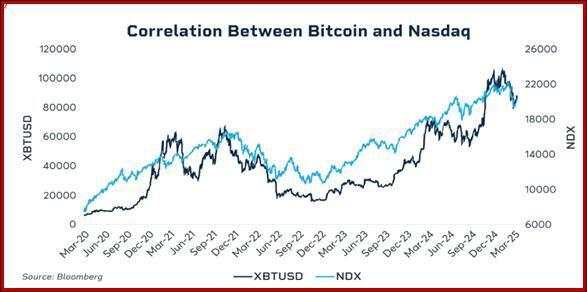

Tidbit: Something we did not know: Bitcoin tracks the Nasdaq. The reason is that bitcoin is bundled with the Nasdaq traders who know how to deal with volatility, according to a story in Institutional Investor.

“From November 2022 to November 2024, gold and bitcoin moved in a relatively tight correlation, with gold gaining 67% while the more volatile bitcoin surged nearly 400%. Analysts widely believed that the two assets would continue to move in tandem, given their shared status as hedges against weak global currency policies. However, this relationship began to fray in 2025. As of late March, gold has risen 16%, while bitcoin has fallen by more than 6%.”

The article explains bitcoin’s fall, in part on “sell on the news,” Also, “… gold’s strength may be partly a result of bitcoin’s weakness. The total market capitalization of cryptocurrencies, estimated at around $2.8 trillion, has pulled money away from the more traditional dollar hedge of gold. It would stand to reason that if bitcoin was in a period of weakness, perhaps investors seeking safety and stability might turn to gold, which has a history spanning thousands of years as a reliable store of value.

“One aspect that cannot be overlooked is the historical context of the two assets. Gold has been a store of value since ancient Egypt in 4000 BC, while Bitcoin’s history dates back only to 2011. Many argue that Bitcoin still has a long way to go before it can be considered a mature asset on par with gold. However, others contend that Bitcoin’s rapid development in the digital age is unprecedented and that it is maturing at an accelerated pace.”

It's still useless. It’s not money because cannot be used in daily transactions, and it’s imaginary, photos of gold-colored coins notwithstanding.

Tidbit: Trump is off today to attend the Pope’s funeral. Bet of the month: how will he embarrass himself and the US?

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

作者:Barbara Rockefeller,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()