The National Bank of Hungary is expected to keep rates on hold at 6.50% next week, as core inflation remains high despite last month's drop in the headline rate. Economic data and US tariffs pose downside risks to GDP, and recent commentary from the Governor indicates no change in forward guidance. We expect rates to remain unchanged this year.

Another meeting, another decision to leave rates unchanged

Next Tuesday, the National Bank of Hungary (NBH) will meet for the first time following April's so-called "Liberation Day" and the release of March inflation data, which marked the first drop in the headline rate this year.

A lot has happened since the March meeting, and for the NBH, we don't think anything is likely to change on forward guidance. Rates are certain to remain unchanged at 6.50%.

The global environment has brought a lot of stress and risk-off sentiment since last month's meeting, usually negative for HUF assets. However, EUR/HUF is higher by ‘only’ 2%, which can be considered a relatively stable reaction given the usual volatility. At the same time, oil and gas prices fell significantly, amplified by higher EUR/USD for the CEE region and supporting disinflation in Hungary.

On the local side, March's lower-than-expected inflation came as a surprise, falling from a 5.6% year-on-year peak to 4.7% YoY (in line with the NBH forecast), while core inflation remains uncomfortably high at 5.7%. On the positive side, we're yet to see the full impact of government measures; both our forecasts and those of the NBH expect this could push inflation down further to 3.8%. Still, the next few months should see higher inflation again, although the government's actions here create some downside risk, given that it is hard to quantify how successful they will be.

Economic data continues to surprise on the negative side, while US tariffs point to further downside for the Hungarian economy's GDP outlook this year and next. In the aftermath of recent tariff announcements, the NBH stated that the measures could take 0.5-0.6ppt off GDP growth overall. Things may have calmed down a bit for US-EU relations since then, but the downside risk remains clear.

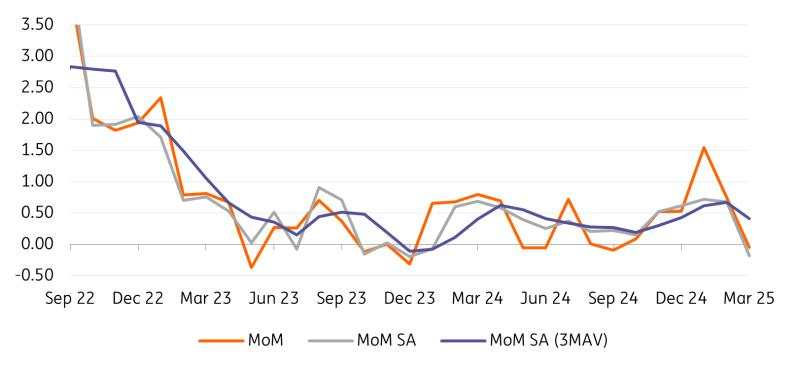

Inflation momentum slowing down after 1Q upside surprise

Source: Macrobond, ING

Too early for forward guidance changes

The overall picture for the Hungarian economy has been moving in a dovish direction since the central bank's March meeting, with lower inflation, government measures and downside risks to an already weak economic outlook. However, we believe it is too early for any reversal in forward guidance. NBH Governor Mihály Varga has reiterated several times in recent days that the focus remains on domestic inflation and warned of the inflationary impact of US tariffs.

We think the message is clear: rate cuts aren't on the table for the time being, and there won't be any change in forward guidance indicating otherwise.

For now, at least, we believe that the possibility of a rate hike may disappear from the discussion, given that the situation on the domestic side and FX volatility have calmed recently.

We continue to see rates unchanged this year and have the first rate cut in our forecast for March next year. The inflation picture looks a bit better after the March number and the economic data, but it is too early in our view to change anything on the baseline scenario, although the likelihood of some rate cut late this year has increased slightly. Still, after April's inflation low we expect a resurgence above 4% for the rest of the year. For a change in the NBH story we would need to see more downside surprises looking ahead in our view.

Read the original analysis: NBH preview: A policy standstill despite Hungary’s dovish turn

作者:ING Global Economics Team,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()