As the week is coming to an end we have a look at next week’s calendar. On Monday, we get from the UK April’s CBI distributive trades while on Tuesday we get Germany’s forward looking GfK consumer sentiment for May, Sweden’s preliminary GDP rate for Q1, Euro Zone’s business climate for April, the US consumer confidence indicator also for April and the US March JOLTS job openings figure. On Wednesday we get Japan’s preliminary industrial output growth rate for March, China’s Caixin and NBS manufacturing PMI figures, Australia’s CPI rates for Q1, the Czech Republic’s, France’s, Germany’s and the Euro Zone’s preliminary GDP rates for Q1, the preliminary HICP rates for April of France and Germany, Switzerland’s KOF indicator for April, the US ADP national employment figure for April, Canada’s GDP rate for February, the US Core PCE Price index for March and we highlight the release of the US GDP advance rate for Q1 and on a monetary level, we note from Canada that BoC is to release the Summary of monetary policy deliberations of the April meeting. On Thursday, we highlight the release of Japan’s BoJ interest rate decision while from the US we get the weekly initial jobless claims figure and the ISM manufacturing PMI figure for April and from Canada the S&P manufacturing PMI figure also for April. On Friday we get Australia’s PPI rates for Q1 and retail sales for March, Euro Zone’s preliminary HICP rate for April, the US factory orders for March and we highlight the release of the US employment report for April.

USD – US GDP and employment data in focus

Fundamentals may have been the main market mover of the USD as US President Trump performed a U-turn. US Treasury Secretary Bessent’s commented that an easing of trade tensions with China is possible, also adding that should there be a trade deal with China, tariffs would be substantially reduced, something verified by Trump as well. Also US President Trump asserted that trade talks were underway, despite China refuting this earlier on. Also easing the market’s worries were the news that China is considering rolling back tariffs on a number of US products, which would be the first tangible albeit temporary act of de-escalation. US Treasury Secretary Bessent stated that the current situation is not sustainable which is obvious on both sides of the front, which could be highlighting the willingness of the US to strike a deal with China. Furthermore the US President backed off from further attacks on Fed Chairman Powell, which eases the pressure on the bank to cut rates and thus may allow it to play a supportive role for the USD.

On a monetary level, we note the market’s dovish expectations as Fed Fund Futures imply that the bank currently widely expects the bank to remain on hold in its next meeting yet also seems to be pricing in three rate cuts until the end of the year. Yet Fed policymakers seem to maintain doubts for extensive rate cuts, and its characteristic how Cleveland Fed President Hammack is advising patience as the bank is assessing what the impact of the US tariffs will be on the US economy. Any doubts for the necessity of extensive rate cuts could contradict the market’s expectations thus providing some support for the USD.

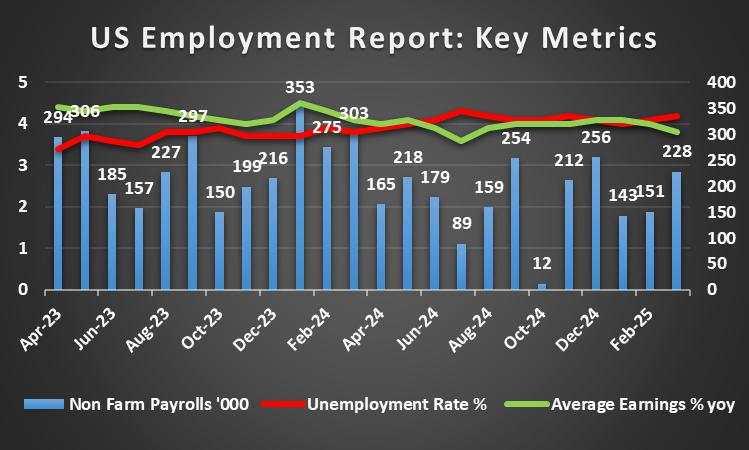

On a macroeconomic level, we are entering a week with a heavy calendar full of high impact US financial releases. We highlight on Wednesday the release of the US GDP advance rate for Q1 and a wide slowdown of the rate is expected. Should the release reignite market worries for a possible recession in the US economy we may see the greenback slipping against its counterparts, while a possible acceleration could ease market worries and support the USD. On Friday we highlight the release of the US employment report for April. Expectations are for the data to show an easing of the US employment market and if actually so, could weigh on the USD as it may enhance the market’s dovish expectations for the Fed.

Analyst’s opinion (USD)

Overall we have an interesting mix of fundamentals and financial data for the USD in the coming week. We expect the USD to remain very sensitive to any headlines reeling in in regards to US President Trump’s intentions. On a deeper level, we note the worries of the market for a possible recession or a slowdown of the US economy and we see the risks as tilted to the downside which could continue weighing on the USD, yet the release of the US GDP advance rate may reverse that sentiment, while the release of the US employment report for April on Friday could also prove to be a market mover for the greenback.

GBP – Fundamentals to lead

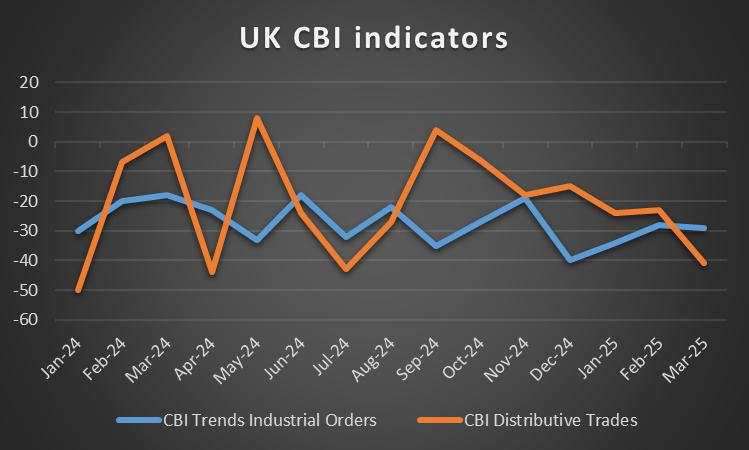

On a macroeconomic level, pound traders got some worrying signals from UK financial data in the past few days. We make a start by noting the drop of the preliminary Services PMI figure for April. The indicator’s reading dropped below 50 implying an unexpected contraction of economic activity in the crucial UK services sector, intensifying market worries for the UK economic outlook. Furthermore the slowdown of the retail sales growth rate for March was less than expected in a positive signal for the demand side of the UK economy. Furthermore, CBI reported an improvement in industrial orders, also for April. In the coming week, we note a relatively light calendar with only a few high impact financial releases from the UK, hence we expect fundamentals to lead the pound.

On a political level we note the ongoing negotiations between the UK and the US. The UK seems willing to reduce tariff and non-tariff barriers of entry for US products in the UK economy and a possible deal reducing US tariffs on UK products could provide some support for the pound. Yet we would like to put the whole deal on the balance before expressing an opinion. Across the Channel the UK Government is reported to be close to reach a new defence agreement with the EU and if actually so, the issue could provide some support for the pound. Overall we see the case for any improvement in UK-EU relationships to be supportive for the pound.

On a monetary level, we make a start by noting that the market almost fully prices in that BoE is to cut rates by 25 basis points in its next meeting on the 8th of May. Yet the market also seems to expect at the current stage, that the bank will deliver another two rate cuts until the end of the year. We note that recently BoE Governor Bailey highlighted the risk to economic growth by the distortion in global trade and noted that BoE is to reach an interest rate decision in two weeks’ time, which in turn was interpreted as a signal for a rate cut in the May meeting, so there may be a dovish inclination among BoE policymakers. Overall should the bank’s dovish signals intensify over the coming week, we may see the bank’s stance weighing on the pound.

Analyst’s opinion (GBP)

Overall we see the case for the pound to be affected primarily by fundamentals. On a monetary level, any further dovish signals from BoE could weigh on the pound while an improvement of the US-UK and EU-UK trade relationships could provide some support for the pound.

JPY – BoJ expected to remain on hold next Thursday

On a macroeconomic level for JPY traders we note that last Friday the release of Japan’s CPI rates for March sent mixed signals as the headline rate slowed down while the core rate accelerated. Yet even with that movement, both rates are still substantially higher than BoJ’s target, thus could allow the bank to proceed with more rate hikes. Please note that Tokyo’s CPI rates for April accelerated beyond market expectations, in a possible prelude for the nationwide rates, given the density of the population of the Japanese mega city. On the other hand we have worries for the growth of the Japanese economy as the preliminary manufacturing PMI figure for April remained in contractionary mode yet in the Services sector the expansion of economic activity was expedited.

On a fundamental level, we continue to highlight the possible adverse effects on the Japanese economy from Trump’s tariffs, with the highlight being on the Japanese auto-manufacturing sector. The issue in our opinion continues to weigh on the JPY as it weighs on the outlook of the Japanese economy. Furthermore we note the dual nature of JPY as a safe haven and a national currency. Should the market’s worries continue to ease we may see the JPY slipping.

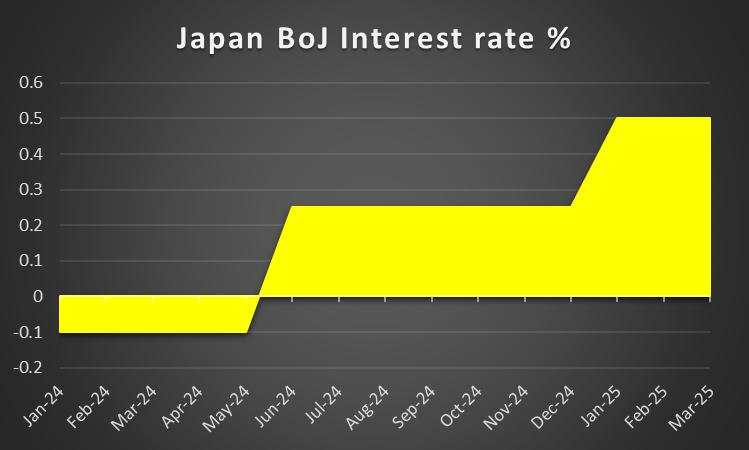

On a monetary level the highlight for Yen traders in the coming week is to be BoJ’s interest rate decision next Thursday. As per JPY OIS the market, as these lines are written, seems to expect the bank to remain on hold and to remain at that level, with the expectations for a rate hike reaching almost 50% for the December meeting. A number of analysts tend to highlight the possibility of the bank proceeding with more rate hikes with one possibly being on Q3, citing BoJ’s focus on the inflationary pressures in the Japanese economy. Hence market attention is expected to shift on the bank’s forward guidance which is to be included in the accompanying statement and the press conference which is to follow. We expect the bank to cite the uncertainty caused by Trump’s tariffs regime which may ease any expectations for a rate hike and thus could weigh on the Yen, yet should the bank’s focus shift towards inflationary pressures it could be signaling a possible rate hike thus supporting JPY .

Analyst’s opinion (JPY)

We expect BoJ’s interest rate decision and specifically the bank’s forward guidance to be the key issue behind JPY’s movement in the coming week. A more dovish stance on behalf of the bank could weigh on the Yen. Furthermore on a fundamental level, we note that should the market worries ease further, JPY may experience some outflows.

EUR – Preliminary HICP and GDP rates in focus

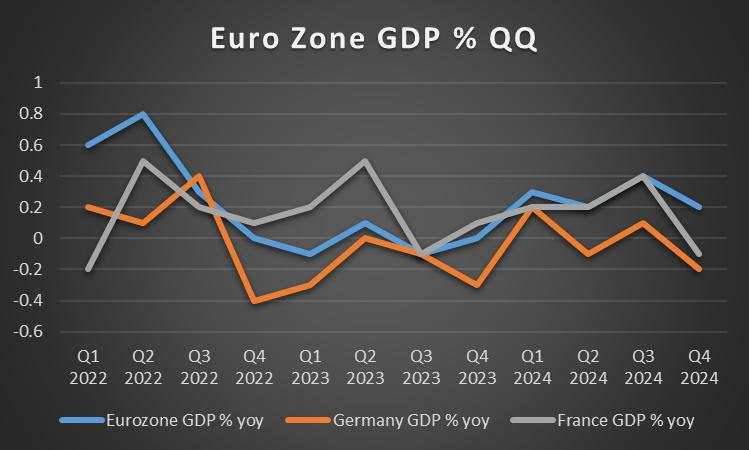

We highlight the Euro Zone’s financial data due out in the coming week as a key factor for EUR’s direction. We make a start with the preliminary HICP rates for April and a possible slow down, could allow the common currency to slip lower as a slowdown could enhance the market’s expectations for the ECB to cut rates. On the other hand, should the preliminary GDP rates for Q1 accelerate, showing growth again on a quarter on quarter level, it could provide support for the EUR as market worries for a possible recession in the economy of the Euro Zone could ease. At this point besidesthe rates of the Euro Zone, we highlight the importance of the GDP and HICP rates related to Germany as the largest economy in the Euro Zone.

On a monetary level, we note the comments of ECB President Lagarde yesterday, as she stated that she expects, Trump’s tariff wars to have a disinflationary effect on the economy of the Euro Zone which in our opinion could enhance the ECB’s intentions for more rate cuts. Should more dovish signals be sent by ECB policymakers we may see the market’s dovish expectations being enhanced and weighing on the EUR. For the time being we note that the market is currently expecting the bank to deliver two maybe three more rate cuts, until the end of the year.

On a fundamental level, we view the EU Commission’s and German Government’s expansionary fiscal policy intentions as supportive for the common currency. On the other hand, Trump’s tariffs tend to weigh on the common currency and currently hopes of market participants for an EU-US summit are on the rise. Any further developments that could imply an easing in the tensions of the EU-US trade relationships could be supportive for the EUR.

Analyst’s opinion (EUR)

We see the case for EUR traders in the coming week focusing primarily on the release of the preliminary HICP and GDP rates. An acceleration of either the HICP or the GDP rates could provide support for the common currency. Other than that we note on a fundamental level, the tensions in the EU-USD trade relationships which tend to weigh on the EUR, as do the dovish intentions of the ECB.

AUD – Australia’s Q1 CPI rates in focus

Fundamentals and the US-Sino trade war in particular may have been the main mover for the Aussie in the past few days. The increased hopes for an easing of the US-Sino trade tensions tend to be supportive for the Aussie given the close Sino-Australian trade relationships. Given the sensitivity of the Aussie to developments in the Chinese economy we note the release of Chinese manufacturing PMI figures for April and should the indicators imply a faster expansion of economic activity in the sector we may see the Aussie getting some support, while a slower expansion or even a contraction of economic activity in the Chinese manufacturing sector could weigh on AUD.

On a monetary level for the Aussie we note the very dovish expectations of the market for RBA to cut rates five more times until the end of the year, starting in its next meeting in May. Yet in a report released yesterday, RBA downplayed the effect of the path of interest rates on households. The report’s findings could imply that the bank may not be as aggressive in rate cutting, as the market may be expecting. Should we see further dovish signals from the bank we expect them to have a bearish effect on the Aussie, while a hesitation on behalf of the bank to extensively cut rates may support the Aussie.

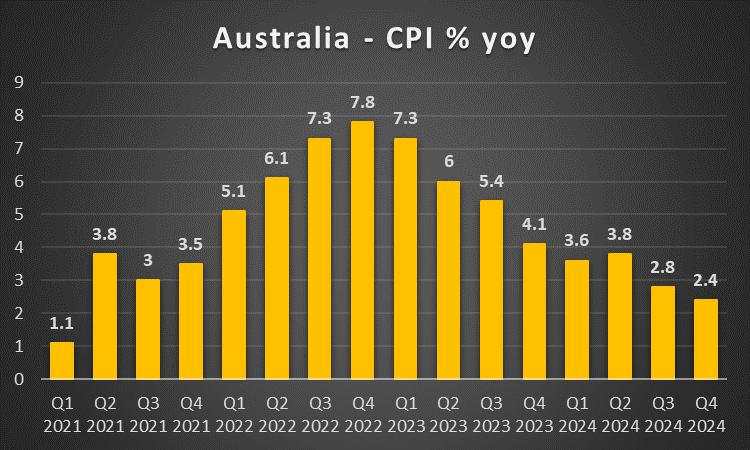

On a macroeconomic level, we note the retreat of April’s preliminary PMI figure, implying a slowdown in the expansion of economic activity and we highlight the release of the Q1 and March’s CPI rates next Wednesday. Should we see the rates accelerating we may see the Aussie getting some support as the release could imply intensifying inflationary pressures in the Australian economy that could in turn ease market expectations for extensive rate cuts by RBA.

Analyst’s opinion (AUD)

Overall we see fundamentals being the prime factor behind AUD’s direction in the coming week with focus being on the US-Sino trade war. Any signs of tensions thawing could provide support for the Aussie given the close Sino-Australian ties and a possible improvement of the market sentiment could be favoring riskier assets. On a macro level we highlight the release of the CPI rates for Q1 and March and a possible easing of inflationary pressures could weigh on the Aussie and vice versa.

CAD – Federal elections coming up

On a fundamental level for Loonie traders, we note that the Canadian Federal elections are looming, as they are to be held on Monday. There seems to be a wide interest in the elections in contrast to elections in the past, which tends to increase the uncertainty of the outcome, while the Trump factor tends to favour the Liberals. For the time being expectations are for the Liberals to win an absolute majority, possibly in which could have a short-term impact on the CAD, while a surprise win of the Conservatives may cause the CAD to rally. Yet the main issue puzzling CAD traders are the US tariffs on Canadian products at the current stage. Should we see an easing of trading tensions between the two neighbours, we may see the CAD getting some support and vice versa. Finally on a fundamental level, we note that oil prices remained relatively stable in the past few days, yet should we see oil prices falling in the coming week, it could have a bearish efffect on the CAD, given Canada’s status as a major oil producing economy.

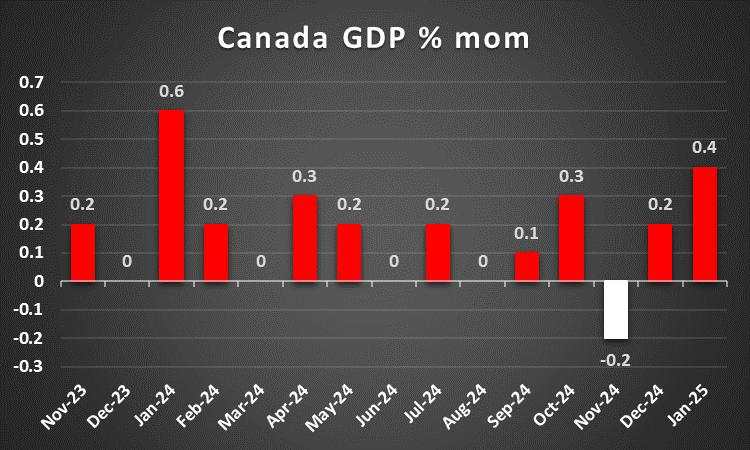

On a macrolevel it was a rather quiet week for Loonie traders, yet Canada’s February retail sales are still to be released as these lines are written and could affect its direction. In the coming week we highlight two releases that may prove of interest for CAD traders. The first would be the GDP rate for February on Wednesday and a possible acceleration of the rate could provide some support for the CAD as it would imply that the economy grew at a faster pace and the second would be April’s S&P PMI figure for the manufacturing sector and should the reading drop even lower signalling an even deeper conraction of economic activity in the sector it could weigh on the Loonie.

On a monetary level, we note the market’s expectatiobns for the bank to remain on hold in its next meeting yet also note thath tte market expects the bank to deliver another two rate cuts until the end of the year. Hence a dovish inclination on behalf of the market is present and any signals to the opposite from BoC policymakers could force the market to reposition itself thus providing some supprot for the Looney. We high light the release of BoC’s Summary of monetary policy deliberations for the April meeting on Wednesday, that could shed more light on the bank’s intentions.

Analyst’s opinion (CAD)

We see the case for the Canadian elections to be of interest for Loonie traders, yet the effect on the CAD should the Liberals get elected could be moderate as the market expects this outcome and is prepared for it. On the flip side a surprise win of the Conservatives could cause the Loonie to rally. The US tariffs on Canadian products remain the main issue on a fundamental level and a possible easing of tensions could support the CAD. On a macroeconomic level we note the release of February’s GDP rate and April’s PMI figures as possible market movers for the Loonie.

General comment

As a closing comment, we expect the USD to remain dominant in the FX market in the coming week given the gravity and frequency of high impact releases from the US in the coming week, but also the dynamic developed by US fundamentals formed primarily by US President Trump given his unpredictability and flamboyant style. As for US Equities markets, a wait and see situation seems to emerge after stopping the bleeding, yet US stockmarkets remain very sensitive to headlines reeling in, while at the same time the earnings period is in full swing adding the complexity of navigating the US equities markets. As for gold’s price, the precious metal has retreated from prior all time high levels and the bullish tendencies seem to ease, yet we may see volatility being just around the corner for the precious metal.

作者:Peter Iosif, ACA, MBA,文章来源FXStreet,版权归原作者所有,如有侵权请联系本人删除。

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()