Forex swing trading is all about using short-term price swings in the forex market to make profits. The goal is to buy at the high points and sell at the low points of those price fluctuations. It’s a flexible approach that blends short-term intraday trading with some overnight positions.

As a swing trader, you don’t need to trade constantly like day traders, but you also don’t have to wait around for months like long-term traders. Instead, swing traders look for trends that are just starting to take off. They buy when prices dip to a lower point and ride the trend as it moves upward. On the flip side, if a currency pair starts moving in the opposite direction at a high price, swing traders can short it to profit from the decline.

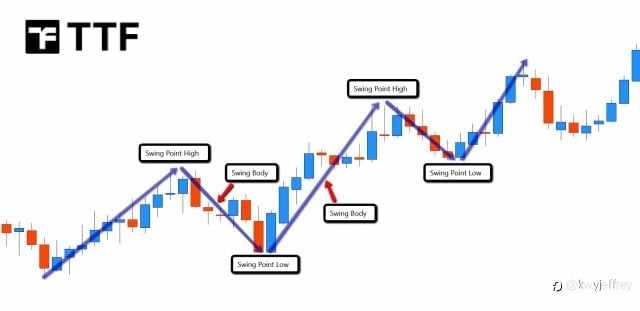

For example, if a trader sees the EUR/USD moving upwards on a 1-hour chart and thinks it will keep climbing, they might wait for a pullback to a support level before jumping in. This is how swing traders operate:

- Market analysis: Traders often rely on technical analysis tools like moving averages or the RSI to spot trends and identify entry points.

- Choosing the entry point: When prices pull back to a support level, traders might buy in, thinking the trend will continue.

- Setting stops: Risk management is key. Traders set stop-loss orders to limit their losses if things go south, and take-profit orders to lock in profits when the price hits their target.

- Monitoring the position: After entering a trade, it’s important to keep an eye on how things are moving. If the trend changes or price reverses, traders might adjust their stop-loss orders to protect gains.

- Exiting the position: When the price hits the take-profit level, the trader closes the position. If the market turns and triggers the stop-loss, the trader exits with a loss.

Swing trading relies heavily on technical analysis, and it requires a good understanding of market charts, indicators, and price patterns. Things like support and resistance lines, and moving averages, are essential tools for identifying when to get in and out of trades.

Another important thing to keep in mind is that swing traders often prefer currency pairs with high volatility because they offer more opportunities to profit from price fluctuations. However, holding positions overnight carries some risk, and traders need to decide whether to carry their positions through the night based on how the market is moving.

For traders who are looking to dip their toes into swing trading, it’s important to develop strong technical skills and make quick decisions. You also need to manage risk properly—setting sensible stop-loss and take-profit levels is crucial to controlling potential losses and staying disciplined. Sometimes it can take time to build up the skills to be successful in this strategy, but once you’re comfortable with it, swing trading can offer some solid opportunities.

By the way, if you're thinking about getting into prop trading, firms like The Trader Funds provide some unique opportunities for traders looking to develop their strategies.

#DayTrading##DayTrader##investment##forextrading##howtomasterforextrading#

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: followme.asia

加载失败()