#DayTrader#

239 浏览

34 讨论

A day trader is a type of trader who executes a relatively large volume of short and long trades to capitalize on intraday market price action.

how to handle leverage in forex trading like a pro

When it comes to forex trading, leverage is a tool that can amplify your profits, but it can also magnify your risks. It’s a double-edged sword. Using leverage effectively can improve your capital efficiency, but misusing it can lead to unnecessary losses. The key is to find a balance and manage you

martingale strategy and how it works in trading

The Martingale strategy is one of those techniques that gets a lot of attention. It's all about increasing your position size as prices move in your favor. This idea comes from Paul Martin back in the '50s, and Larry Williams helped spread the word later on. The basic idea is that if the market move

why mastering one trading strategy is the key to success

So here's a thought I wanted to share based on my experience with trading and focusing on just one strategy at a time. It's easy to get caught up in jumping from one strategy to the next, always looking for the next "holy grail" to fix things. But honestly, the real key to success is focusing on mas

gold vs forex what's the difference

Gold and forex trading are two big markets. Each has its own rules. Both deal with prices, but they’re not the same. Let’s break it down. What You Trade Gold trading? It’s all about the metal. You can go for physical gold or trade derivatives like futures. Gold’s seen as a safe-haven asset. Forex? T

how to trade forex like a pro with these simple strategies

Here are a few day trading strategies in forex that might be worth considering. They’ve helped me in my trading journey, and you might find them useful too. Breakout Trading This strategy is all about jumping in when the market moves big. Basically, you’re watching key support or resistance levels.

understanding pips and how they affect your trades

In forex trading, the concept of "pip" is something you'll hear often, especially when traders talk about price movements. A pip stands for the smallest change in the price of a currency pair. Most major pairs like EUR/USD or GBP/USD move in increments of 0.0001, while pairs like USD/JPY move in 0.0

昨晚美股科技股又洗了一波

昨晚美股科技股真的是大震盪,納斯達克整個被打趴。主要原因還是聯準會主席 Jerome Powell 的發言超出市場預期,直接影響到盤後走勢。 聯準會這次宣佈再降息,基準利率降到 4.25% - 4.5% 區間,但他們的點陣圖顯示,2025 年的降息速度會比預期慢,可能只降兩次。原本市場預估會降四次,所以這一下打破不少人的樂觀期待。 這種情況對高成長股來說壓力很大,尤其是像蘋果 (AAPL)、微軟 (MSFT)、NVIDIA (NVDA)、Alphabet (GOOGL) 這些大公司。它們的估值本來就靠未來的高成長支撐,如果利率保持高檔,那成長故事的吸引力就會打折。尤其科技股普遍對消費支出敏感,

why your trades always feel up and down

Ever feel like your trading is all over the place? Sometimes winning, sometimes losing, but never quite consistent? Moving from being a casual trader to a professional one often boils down to one thing—stability. Let’s talk about a few thoughts on how to improve that. System Optimization Your tradin

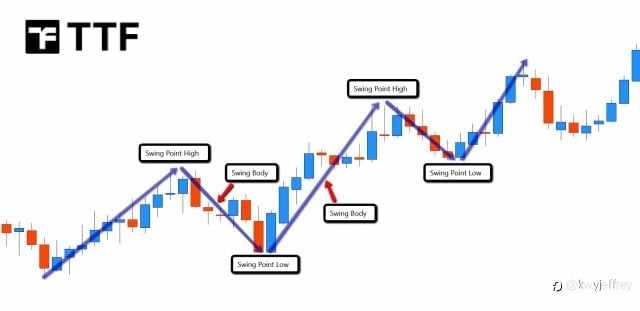

how swing traders catch moves in forex

Forex swing trading is all about using short-term price swings in the forex market to make profits. The goal is to buy at the high points and sell at the low points of those price fluctuations. It’s a flexible approach that blends short-term intraday trading with some overnight positions. As a swing

could trump boost bitcoin in the next 4 years?

Here's my take on how the next few years under a Trump presidency could impact the cryptocurrency scene, particularly Bitcoin. After that rally, with Bitcoin soaring almost 40%, it seems like the crypto market is feeling optimistic. Though Bitcoin's pulled back from $100,000, things still look good

why consistency is key in prop trading

When you trade with a prop firm, there’s often a rule that comes up a lot – the Consistency Rule. It's pretty simple but important for how things work with your trading. The idea is that your big wins shouldn’t make up the majority of your profits. A firm that follows this rule wants to see steady g

understanding dojis, wait for the close

Not every doji signals a trend reversal. It’s just how the market talks—sometimes it’s clear, sometimes it’s noise. Here’s the thing: if you’re looking at a doji on a timeframe, the next candle hasn’t closed yet. That means the story isn’t over. Price could dip a little, then shoot above the doji’s

thinking about longer-term trading? here's the scoop

Alright, so we all know trading is about finding your groove. Some of us love the action on the 5-min chart, while others chill with weekly charts. Let's talk about the longer-term stuff, you know, the slow-burn approach. Why Go Long-Term? Less Screen Time: You’re not glued to the charts all day. Ch

上拉加载